Switch from Credit Karma to Monarch

Turbocharge your finances by switching from Credit Karma

Hey Mint users! Don’t get downgraded to Credit Karma, switch to Monarch and embrace a new kind of personal finance app that’s intuitive, insightful, and ad-free. Try for free for 7 days.

Sign up

Monarch

Credit Karma

Comprehensive budgeting and goals

Monarch's product was built around being actionable with your personal finances —like crushing your debt, spending wisely, and building realistic budgets.

Limited features

Credit Karma currently does not offer any budgeting, spending limit, goal-setting, or proactive financial management capabilities.

No ads and no selling data

We protect your data with bank-level security, and never share it with third parties. We also never show you ads.

Promotion-heavy experience

Credit Karma makes money by promoting credit cards and other financial products to its users - so their interface is filled with ads.

Full Mint history import

Monarch Money supports comprehensive Mint history import, enabling users to seamlessly integrate their entire financial timeline.

Limited to 3 years of history

Credit Karma limits Mint history import to the last three years, erasing any additional history.

Precise bill management

Monarch pinpoints monthly fluctuations in bill payments, alerting you to changes in monthly utilities expenses and other merchant charges

Un-actionable financial insights

Credit Karma is missing bill management capabilities and provides only basic, snapshot-based financial overviews

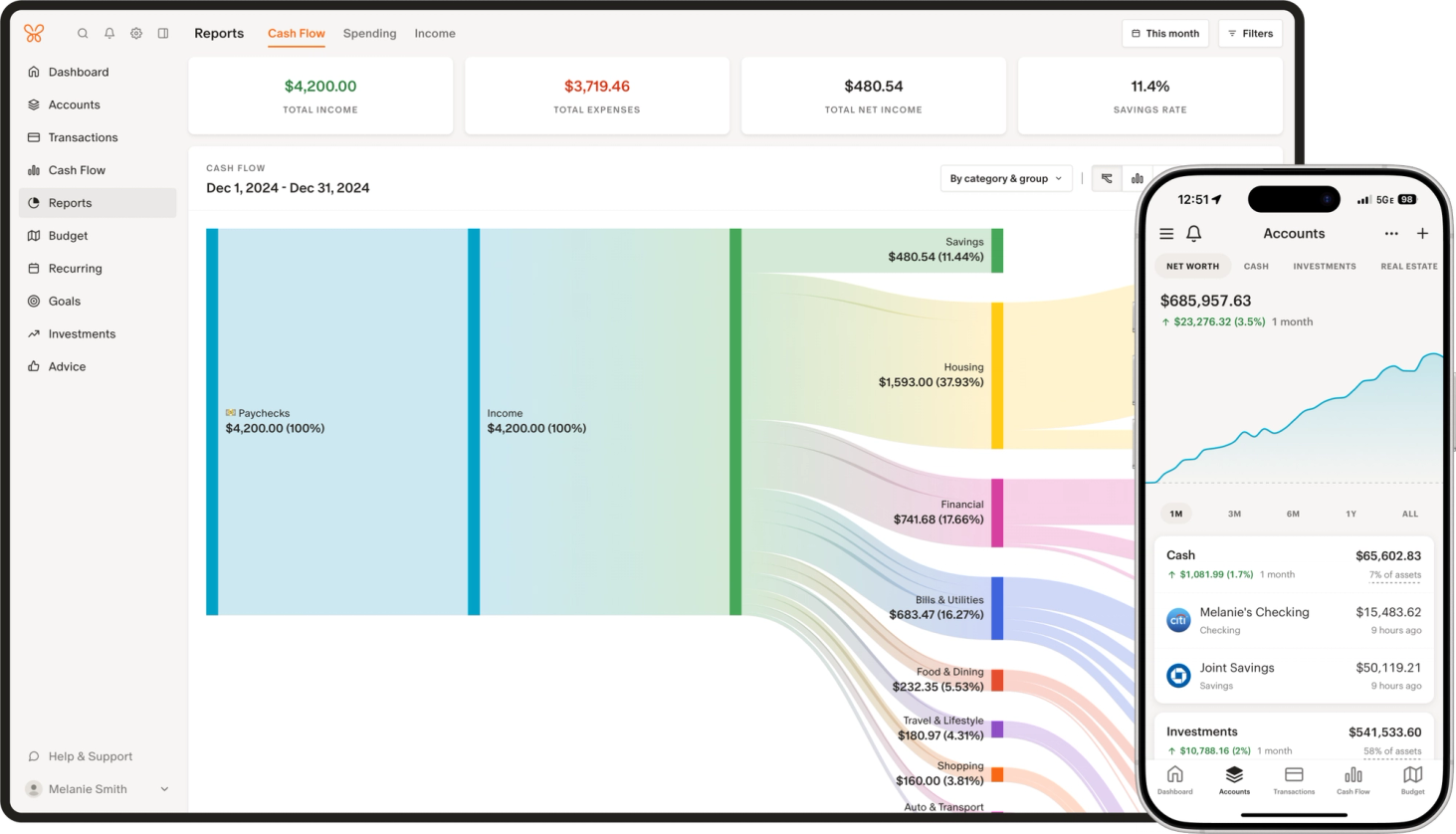

Modern, intuitive design

Monarch has a beautiful, intuitive, and clean design across web, iOS, and Android. We obsess over the details to make sure every piece of the product is easy to use.

Basic design

Credit Karma's product is bare bones, difficult to navigate, and designed to funnel you to paid products.

Robust transaction rules

Monarch's product empowers users to craft personalized transaction rules, enabling tailored control over their financial activity.

Limited rules

Credit Karma only allows users to categorize transactions - no custom rules or ability to change merchant names.

Contribute to the product roadmap

We let our users vote on the features they want us to build next. We use this information to define our product roadmap to ensure we're always building the best product for our customers.

No roadmap visibility

Credit Karma does not have a public roadmap available. Users do not know what Credit Karma is working on next.

Monarch

Comprehensive budgeting and goals

Monarch's product was built around being actionable with your personal finances —like crushing your debt, spending wisely, and building realistic budgets.

No ads and no selling data

We protect your data with bank-level security, and never share it with third parties. We also never show you ads.

Full Mint history import

Monarch Money supports comprehensive Mint history import, enabling users to seamlessly integrate their entire financial timeline.

Precise bill management

Monarch pinpoints monthly fluctuations in bill payments, alerting you to changes in monthly utilities expenses and other merchant charges

Modern, intuitive design

Monarch has a beautiful, intuitive, and clean design across web, iOS, and Android. We obsess over the details to make sure every piece of the product is easy to use.

Robust transaction rules

Monarch's product empowers users to craft personalized transaction rules, enabling tailored control over their financial activity.

Contribute to the product roadmap

We let our users vote on the features they want us to build next. We use this information to define our product roadmap to ensure we're always building the best product for our customers.

Credit Karma

Limited features

Credit Karma currently does not offer any budgeting, spending limit, goal-setting, or proactive financial management capabilities.

Promotion-heavy experience

Credit Karma makes money by promoting credit cards and other financial products to its users - so their interface is filled with ads.

Limited to 3 years of history

Credit Karma limits Mint history import to the last three years, erasing any additional history.

Un-actionable financial insights

Credit Karma is missing bill management capabilities and provides only basic, snapshot-based financial overviews

Basic design

Credit Karma's product is bare bones, difficult to navigate, and designed to funnel you to paid products.

Limited rules

Credit Karma only allows users to categorize transactions - no custom rules or ability to change merchant names.

No roadmap visibility

Credit Karma does not have a public roadmap available. Users do not know what Credit Karma is working on next.

“I tried YNAB, I tried Mint, I use Monarch. So much more intuitive and the UI/UX is delightful.”

App Store Review

I tested at least 30 apps to find the best one that did everything great, and this was the only one that managed to tick ALL the boxes! From ease of use, to features, to being able to access and centralize all data no matter what device I’m on.

App Store Review

"I have tried and used many budgeting apps — Mint, copilot, rocket money— and Monarch is by far the best one. I love the customization and monthly overviews. I feel more in control of my finances."

App Store Review

"Finally a financial dashboard that allows for intuitive customization but also has a powerful set of pre-built functionality! Safe to say we’ve become more aware of our financial situation and made moves toward progress since joining Monarch Money."

App Store Review

“Because of this app, I feel like I am not winging it financially anymore and feel on top of my spending.”

App Store Review

“I love how many features (bill calendar, cash flow manager, easy budgeting, goal setup and tracking, etc) allow you to get a crystal clear picture of where you stand each month.”

App Store Review