Trent and his wife Lauren were like many couples: one of them loved pouring over their finances, while the other was less excited by the prospect of diving into a spreadsheet every week.

With a background in finance, Trent was the spreadsheet keeper. This dynamic worked before they were married, but after the wedding, they had to decide how they wanted to run their financial lives.

“We make nearly equal money, so we preferred to keep our accounts separate,” says Trent. “We just didn't feel a need to combine them. She has Bank of America. I have a local credit union. She has the Chase Sapphire card. I have the Capital One Venture X.”

Combining accounts wasn’t appealing. Meanwhile, the burden of logging every transaction into a spreadsheet was sure to be a source of contention.

“Before getting married we'd never tried saving money together,” says Trent. But with the wedding in the rearview mirror and aspirations of buying their first home around the corner, they had to find a way to make sure they were both contributing to their shared goals.

That’s when they found Monarch.

Stress Free Saving for a Down Payment

“Lauren was really skeptical of really using it,” says Trent. “But after the first two months, she was like, ‘This is awesome!’’”

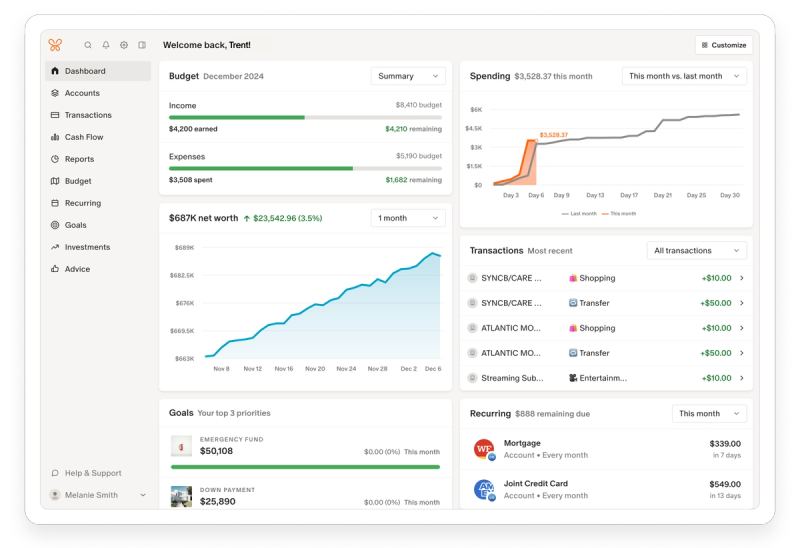

After connecting their bank accounts and credit cards to Monarch, Trent’s spreadsheet became obsolete. Each month, Trent and Lauren would check their Monarch dashboard and make sure they were on track. As long as they were on track, they didn’t have to worry about day-to-day spending.

“We spend money on things that are for us as individuals and not necessarily for us as a couple. Without Monarch, that may have caused some tension,” Trent says. “But seeing each month how much we were saving, none of that mattered to me. We're saving so much each month. And either of us could refer to the app before any splurges to make sure we didn’t harm our long term goal.”

That long term goal? Buying a home.

“Through those first few months we said, ‘If we're actually going to buy a house that we're going to be happy with, we probably need to be at or above $1 million, especially in a high cost of living city like Boston’.”

The couple then worked backwards to set a monthly goal of $9,000 of savings each month.

“That’s a downpayment of $200k to $300k. Once we factor in our existing savings, we have basically 15 months to get there. The dashboard was my go to. It was like the NASDAQ, I checked it daily at some points to make sure we were on track.”

“We blew past our goal”

And then a funny thing happened: what could be a source of anxiety, became a game. The couple took a collaborative approach that worked with both of their budgeting styles, all without combining accounts.

“Now we actually like talking about money and texting about money and looking at our finances together. It was truly a fun project that prevented arguments rather than creating them.”