The American Psychological Association’s 2023 Stress in America survey revealed that roughly 8 out of 10 Americans between 18 and 44 years of age consider money a significant stressor. It’s no wonder financial problems trigger the downfall of many modern relationships too. In fact, one study indicated as many as 36% of divorced individuals listed “financial problems” as one of the “major contributors for divorce.”

These statistics help explain why there are so many financial tools and resources available, many of which are designed specifically for couples. When we have more control over our finances, we mitigate stress and protect our lives and relationships in the process. What a lot of these resources lack, however, is transparency.

That’s why we interviewed Jerry and Kelly.

This modern-day couple in their mid-30s experiences financial stressors like the rest of us. Between finding a home within their budget, balancing goals like travel and retirement, and more, Jerry and Kelly have had many conversations about money over the years. Ultimately, those conversations helped them create financial habits and routines that fit their personalities, their lifestyle, and their desired future.

We’ll provide an honest look into Jerry and Kelly’s finances to help you and your partner consider how shifts in your own money management styles could impact your stress and your future.

Jerry and Kelly’s Financial Overview

Jerry is 36 years old and the director of operations at a family foundation. Kelly is 35 and an instructor at a community college.

Jerry makes roughly $114,000 each year, while Kelly brings in $80,000.

Although Jerry and Kelly do not intend to have kids, they own a small dog and purchased the first home for their little family in 2022.

Jerry and Kelly consider themselves “savers” over “spenders” — a statement their accounts confirm — but admit there are differences between their budgeting styles. Jerry generally follows a rigid budget and monitors his spending on an almost daily basis. Kelly, on the other hand, prefers to check her credit card balance every so often, adapting as needed.

Beyond their approaches to money management however, Jerry and Kelly share many similarities, including interests like travel, trivia, and community involvement. These interests inform not only their monthly spending habits, but also their larger financial goals.

Income

- Jerry’s Annual Salary: $114,000

- Kelly’s Annual Salary: $80,000

Key Expenses

- Mortgage: $2,000

- Bills & Utilities: $650 (includes pet insurance, TV, and other subscriptions)

- Groceries: $550

- Gas: $160

- Auto Insurance: $100

- Life Insurance: $60

- Dining Out: $800 (includes a wine club membership)

- Fun Money: $800

- House Supplies: $320 (includes participation in a local charity)

Savings

- Jerry’s Retirement Savings: $173,000

- Kelly’s Retirement Savings: $80,000

- Emergency Fund: $20,000

- Investments: $19,500

- Misc. Savings: $20,000

Debt

- Mortgage: $290,500

- Student Loans: $40,000

- Credit Card: $6,500

How would you describe your budgeting style?

“I would describe myself as ‘budget-conscious,’ and I would describe Kelly as ‘hands-off,’” Jerry laughs.

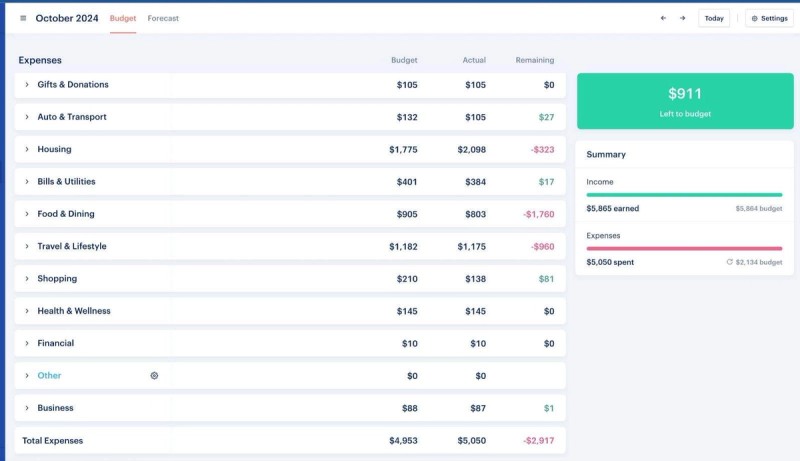

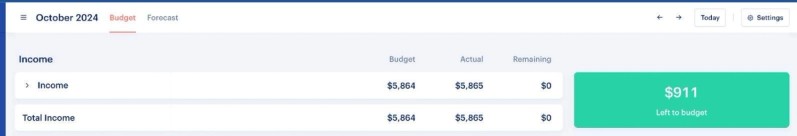

According to Kelly, finance is a “hobby” for her partner, which explains why Jerry happily manages the bulk of their finances — “outside of our water bill for whatever reason,” he says. This includes regularly monitoring their budget via the Monarch Money app.

“I am much more lackadaisical about budgeting, whereas Jerry is rigid and disciplined,” says Kelly.

“I’m so OCD that I don’t even have our mortgage payment set up on autopay,” Jerry adds.

Additionally, Jerry and Kelly work with a financial services company to help them manage their investments and retirement accounts, as well as assist with long-term financial planning. When it comes to traditional “budget meetings” of their own however, this couple prefers to keep things simple.

“At the end of the month, we just do a quick touch base,” says Jerry. “Honestly, it’s usually via text message. I’m budgeting and will say, ‘Hey, just a heads up, we’re a little high on groceries this month.’”

For day-to-day budgeting, texts do the trick for Jerry and Kelly. If they identify a larger, upcoming expense or want to plan a trip however, they’ll sit down and have a meeting.

Do you have a joint bank account, separate accounts, or both?

With the exception of a joint savings account and some retirement/investment accounts, Jerry and Kelly have kept the majority of their expenses separate.

While the pair joke this choice is, in part, due to “laziness,” the reality is separate accounts have worked well for Jerry and Kelly for several years. Since they approach money management differently, keeping their checking accounts separate allows Jerry and Kelly freedom to budget according to their own unique preferences.

“I think it would add some additional stress to our relationship if we were to combine accounts,” Kelly says.

Nevertheless, since Jerry and Kelly do make large purchases for their home, trips, and such, they share a joint savings account to fund shared expenses.

How do you and your partner divide or share financial responsibilities like paying bills?

Together, Jerry and Kelly make a combined $195,000 each year, and while Jerry makes more money, they generally split their expenses evenly.

“Most of the day-to-day expenses we split relatively 50/50,” says Jerry. “Groceries, going out to restaurants, mortgage, gas, things like that.”

There are some exceptions to this rule, however. For instance, Jerry says he often chips in a little more on trips to visit his family on the East Coast.

As was the case with keeping their accounts separate, the choice to split expenses evenly despite the $34,000 gap between Jerry and Kelly’s salaries was made intentionally.

“Being limited by my lower income has kept us from increasing our budget items too much,” Kelly shares. “I think that’s helped us with lifestyle creep.”

Tell us about a major financial decision you and your partner navigated together.

In August of 2022, Jerry and Kelly purchased their first home in Oregon: a 1940s, three-bed, one-bath Craftsman.

Jerry was thrilled to find a property close to downtown shops and restaurants. Kelly was relieved to find a charming, old home that wasn’t built in a flood zone. Unfortunately, the house lacked one key item on their wishlist.

“We wanted at least two baths,” says Kelly. “Between our budget and the geography, there wasn’t a lot available to us, but with this place we could have enough cash leftover after the purchase to add a bathroom.”

While renovating wasn’t initially part of Jerry and Kelly’s plan, they knew this home could meet all of their needs. “I think we both loved it enough that we thought, ‘We can make this work,’” says Kelly.

Shortly after closing on the home, Jerry and Kelly started requesting estimates for a complete bathroom remodel, but were stunned by the quotes they received. Instead, they pivoted to a new question: What can we do ourselves? “We were very lucky, because Kelly’s dad is extremely handy and was able to guide us through a lot of things,” Jerry shares.

While Jerry typically handles the couples’ budget, he was happy to pass authority over to Kelly for the bathroom remodel. “We put together a big spreadsheet, and Kelly took the lead,” he says. They itemized all of the individual purchases they needed to make and jobs they needed to complete, along with estimates from plumbers.

“Kelly [researched] items like the vanity, the mirror, etc. She would identify some options, and then we’d talk through them together,” says Jerry. “There was never a financial disagreement… more like an aesthetic disagreement,” he laughs.

While Jerry and Kelly knew they could afford the cost of a bathroom renovation, they decided to place all of their purchases on a credit card offering an 18-month 0% APR bonus to spread out the expenses. They’re currently carrying a $6,500 balance on the card and have slowly chipped away at the balance, but intend to pay down the remainder once the 0% APR period has ended.

What are your primary financial goals?

Beyond their usual spending and saving, Jerry and Kelly have established a few key financial goals to help them think beyond the day-to-day.

First, Jerry and Kelly prioritize saving for travel.

“We want to travel internationally every other year, so we’re making sure we have enough cash on hand to make that happen,” says Kelly.

“The other thing is just ensuring that there’s money to visit my family on the East Coast one to two times a year,” Jerry adds.

Jerry and Kelly aim for a cushion of $15,000 in their savings account to cover the occasional international trip, as well as $3,000 for domestic flights to see Jerry’s family.

Next, Jerry and Kelly are saving up for several remodeling projects in and around their home.

“We have a few big house projects coming up, like $15k to $20k-type house projects,” says Kelly.

Jerry and Kelly are checking off these projects as funds become available, but anticipate they’ll spend roughly $30,000 on house projects over the next three years.

Finally, Jerry and Kelly are saving for retirement.

Jerry and Kelly are intentionally child-free, which Kelly says simplified some of the conversations around setting financial goals.

“We’re not having to save up for a potential birth or being off work for a period of time or child care or college savings,” she adds.

However, Jerry and Kelly also acknowledge that a child-free retirement has its drawbacks, since they’ll have to make sure there’s money saved to take care of them both as they age. Although Jerry and Kelly are contributing to their individual retirement accounts regularly, they want to increase their contributions to max out the accounts in the near future.

How would you describe your financial upbringing?

Jerry and Kelly have developed a number of healthy habits to manage their money, but just like any couple, they entered the relationship with unique financial backgrounds.

“I’ve always been a lot more anxious about money,” says Kelly. As a kid, who remembers listening to her parents argue about finances as a child. “Things were usually pretty tight in my household until high school.”

Unfortunately, just as her family’s financial stressors softened, Kelly went to college and began preparing for a career in education.

“In this industry, you’re an adjunct. You get what work is given to you, you’re not guaranteed income for the next term until you get your contract, and the pay is very miserable,” says Kelly. “It’s really been the last three or four years that I’ve had a consistent, regular income and felt a bit more stable.”

Meanwhile, Jerry’s upbringing was much more secure.

“Money was never really a major concern in my family,” he shares. “I was middle class, going to extracurriculars and things like that. Everything was fine.” Not to mention, Jerry’s father was an accountant, so Jerry adopted a habit of budgeting early in adulthood.

Despite the differences in their upbringing, when Jerry and Kelly started dating, they were in similar positions financially.

“We were both poor,” says Kelly. “I was in grad school in California. He was a public school teacher in North Carolina.” As the couple grew closer, they spent more time and many conversations not only acknowledging the differences in financial histories, but developing a money management style that worked for both of them.

“We were long distance for about a year, so we got a shared credit card to earn frequent flier miles and pay for flights back and forth,” says Kelly.

“Which was less than two years into our relationship,” Jerry adds. “I guess we trusted each other enough to not screw it all up.”

How do you maintain healthy financial habits in marriage?

Jerry and Kelly certainly have their differences when it comes to financial habits. After all, Jerry has a category for every expense and tracks his spending almost daily in the Monarch Money app. Meanwhile, when Kelly’s credit card balance is a little high, she prefers to “lock it down.”

But more often than not, Jerry and Kelly are quite aligned.

They enjoy spending money on traveling and investing in their community. They’ve settled on financial goals like preparing for a child-free retirement and prioritizing large projects to improve their home.

“As you get deeper into a relationship, it’s not about the frequent flier miles,” says Jerry. “It’s deeper, philosophical conversations about where you want your life to be.”

Jerry and Kelly lean into their natural tendencies toward saving, because they know it helps them achieve long-term goals. They’ve limited their spending — despite earning more money today than when they met — because they know it helps them focus on traveling and maintaining a home and saving for retirement.

Sure, they’re up for the occasional thrift find or spontaneous trip to the East Coast, but their financial goals are always front and center.

“Having that disposable income, you start to think about, ‘What do we want to do with this money?’” says Jerry. “We want to actually utilize it to make our lives better, both in the short-term and the long-term.”