On the surface, Theo and Dana were arguing about knick knacks and home improvement ideas. But, like most arguments, it was actually about something bigger.

“She tends to spend more on things that provide delight and happiness in the house,” says Theo. “And meanwhile I could live with plain white walls all day.”

Whether it was their wedding or a home improvement project, no matter what budget was set, the couple seemed to go over, and the anxiety was eating away at Theo. “I tend to be frugal and I could not figure out how we were going over every time,” he says. “We would just bicker and fight about finances.”

Meanwhile Dana would ask Theo, “Why are you worried about this? We both make good money!”

That’s when it hit Theo. His anxiety was because, “I have no idea whether we're doing well, whether we're not doing well,” he says. “To help me feel better, I started grabbing our expenses and I put it on a Google Sheet. But I was always missing something. We had investment accounts. We have a bunch of credit cards.”

It became too much work and categorizing things would take hours. And then the fights would happen all over again. One day when complaining to a friend that there needed to be a better way to track expenses, the friend suggested another option.

“Monarch feels like a life hack,” his friend told him. “You have to try it.”

“The foundation for our financial conversations”

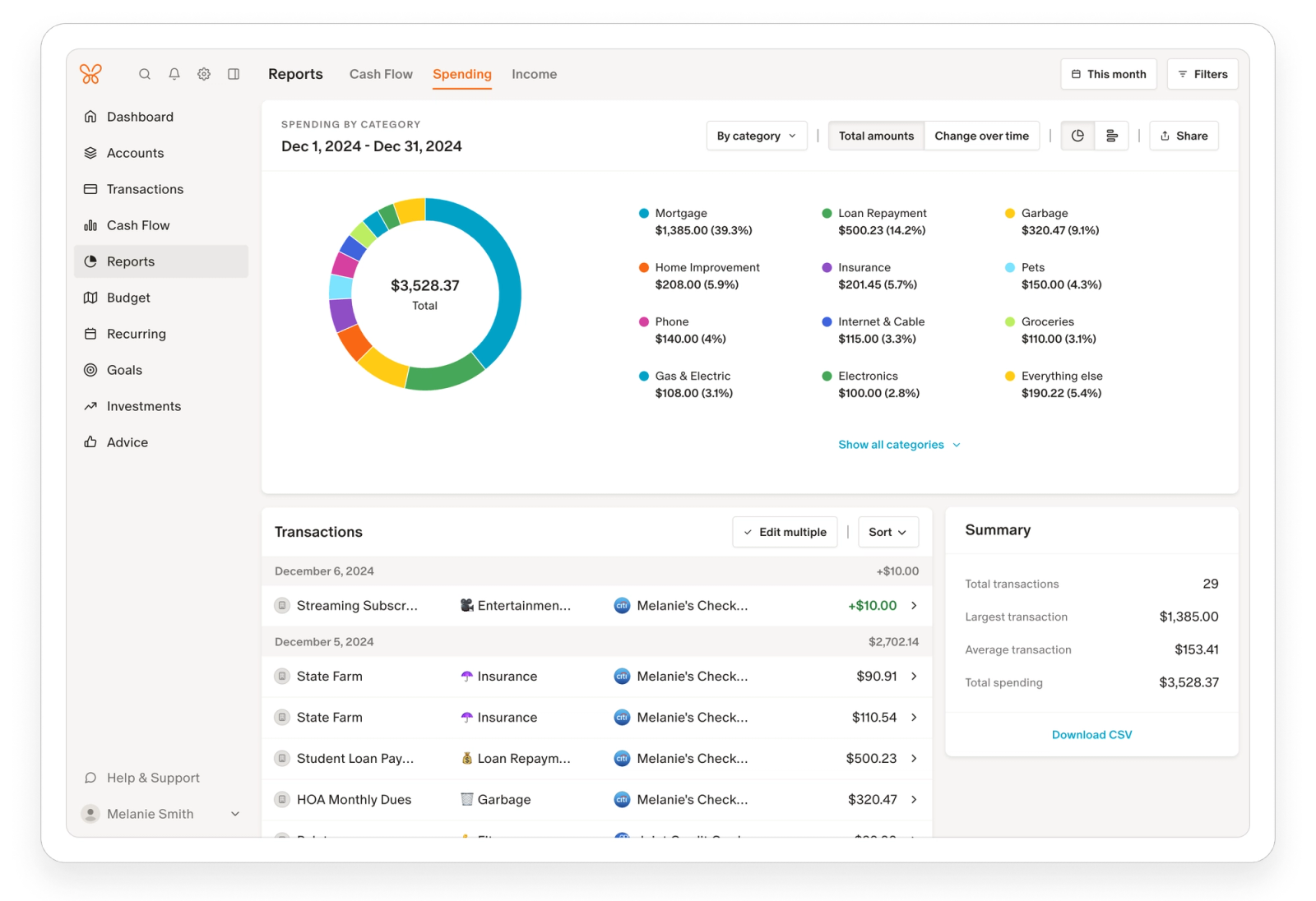

Theo and Dana spent some time one weekend gathering their bank accounts, credit cards, and investments. Within minutes, Monarch had not only categorized their spending and revealed meaningful insights, but also created the transparency they needed to have better conversations about money. The couple keeps separate accounts for everything, but seeing it all in one place began to ease Theo’s anxiety as their financial picture became clearer.

“Now my money anxiety has gone from 100% to less than 10%. It’s been night and day,” he says.

The couple set budgets and saw that if one project goes over, they can move money around from other places. The hours spent hacking away at a spreadsheet and the evening arguments that came with it faded from view.

“It's the foundation for any financial conversation,” says Theo. “Every quarter we'll pull up Monarch and now she and I are engaging in productive conversations about our finances.”

“She used to not really care about finances. And now she's like, ‘wow, we spent that much money on fitness this past like three months?’”

Theo liked that he could zoom out to see marco trends. That allowed the couple to talk less about transactions and more about their big picture goals.

“We eventually want our passive income to be higher than our expenses, so that theoretically we don't need to work. And so we have a goal set up for that within Monarch,” he says. With the goal set in Monarch for various passive income projects, when they discuss money they talk more about where they are going instead of where they’ve been.

The visibility has allowed them both to still do the things they love without it resulting in an argument about money. Dana’s love of working on home design projects has its own budget which has relaxed Theo's nervousness about spending and has allowed him to appreciate the work that Dana puts into making their house Pinterest-worthy.

“We still go over budget, sometimes. But now we both can see it and figure out what to do next, rather than arguing about whether we spend too much or not,” he says. “We can have more productive conversations.”

“Monarch made us thousands”

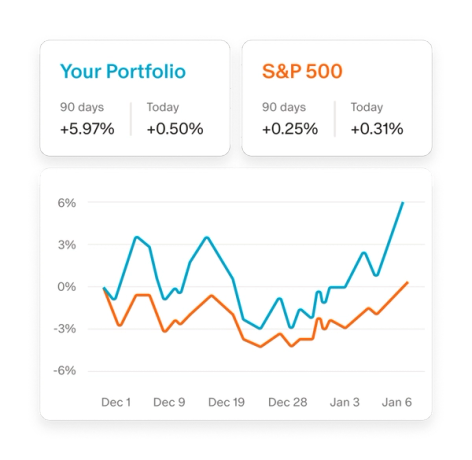

No longer winging it or putting hours into an imperfect spreadsheet, Theo and Dana were able to zoom out and spend more time analyzing their investments — especially with their goal of passive income. The investment screen of Monarch was a favorite.

"That has been huge because there were a lot of robo advisors we were using that consistently underperformed the S&P 500. We withdrew all of our money from that and we just put in the S&P 500,” says Theo. “From that insight alone, Monarch made us thousands. That awareness allows you to make those intelligent financial decisions."

"Monarch is a game changer,” says Theo. “I would pay a thousand dollars for it."