At first glance, credit cards that offer points for purchases may seem like an obvious win. You’re basically getting bonus free stuff for buying other stuff? Yes, please. I’ll admit, I’ve been an avid user of credit card points for years, and naively walked into reporting this article assuming the answer to, “Are credit card points worth it?” was “Duh!”

But dig beneath the surface, and you’ll quickly realize that points cards don’t make sense for every financial situation.

For instance, research has found that:

- Forms of payment that immediately deplete wealth (such as cash or debit cards) lower purchase intent for discretionary items compared to forms of payment that delay wealth depletion (credit cards). (Source)

- Study participants who were told to buy something with a credit card were willing to pay more than twice as much as people instructed to pay with cash. (Source)

- 52% of people are more likely to make an impulse purchase when paying with a card compared to 24% with cash. (Source)

Plus, not every rewards card ensures you come out financially on top.

To help you determine what’s right for you, this article will cover questions to ask yourself before getting a points card, some calculations to help you determine if a specific card is “worth it,” and other considerations in making sure credit card points are truly a benefit.

Should I get a rewards credit card?

To understand common pitfalls that people run into when using a points-based credit card, I chatted with two financial experts, who advised asking yourself the following questions.

Do you have a budget and trust that you can stick to it?

Money-saving expert Andrea Woroch says that she wouldn’t recommend a points credit card to somebody who doesn’t already have a clear view of where their money is going each month and whether their spending habits are supporting their financial goals.

“For somebody who just spends without paying attention, who doesn’t have a good concept of budgeting and trying to save, who hasn’t planned for their future, a reward card shouldn’t be your priority,” she says, recommending implementing a careful budget first. “Ultimately, this will improve your finances and help you save more than if you were using a credit card that was giving you money back, but then you overspent because of that card.”

After all, it’s very easy to waive away spending as being “for the points.”

Once you feel you can be more mindful of where your money is going no matter how you’re spending it, you may consider getting a rewards credit card for added bonus.

Are you easily influenced by gamification?

Researchers at MIT Sloan found that spending with a credit card activates the brain’s reward center, which is the same part of the brain exploited by addictive drugs and casinos. This happens more strongly with credit card purchases than cash, and can drive greater purchasing. And, while there haven’t been studies done specifically on points credit cards, you can imagine that might fire up that rewards center even more.

Catherine Valega, CFP®, EA, CAIA at Green Bee Advisory, says she likes to ask clients about their money story to help them identify whether this will be a problem for them.

“I like to win,” she explains, adding that she’s susceptible to chasing that feeling. “And I grew up lower-middle class, so I always wanted to have more money than I did. I know that about myself, so I do have to be careful of the shiny objects of points.”

Andrea agrees that, “Even if our intention is not to chase the reward, sometimes in the back of our head we may allow ourselves to spend a little more knowing we’re getting something back for it,” she says.

To help avoid this, Catherine recommends being extra mindful to only use your card for money you would already be spending rather than buying more to rack up points, and tracking your monthly spending carefully. A daily text updating you on your balance helps (most credit card providers offer this in their “notifications” settings online). If you notice your expenses going up after getting a rewards card, consider what needs to change to use it more responsibly.

Will you be paying your balance in full each month?

In general, both Catherine and Andrea say the best way to use points cards to your benefit is to ensure you’re paying your balances off in full every month. Catherine prefers to think of her credit cards as something that offers her ease of payment and a bit of a rewards bonus rather than a true line of credit.

If you do carry a balance on your credit card, rewards cards aren’t an automatic no — in fact, Andrea says that in some cases the rewards can help offset some of the money you’re paying in interest. But cards with better rewards may also have higher APR, yearly fees, or shorter 0% introductory periods, so you’ll want to do some extra math to determine if the points you’re earning are actually costing you more money because you’re paying more in interest.

How to calculate if credit card points are worth it

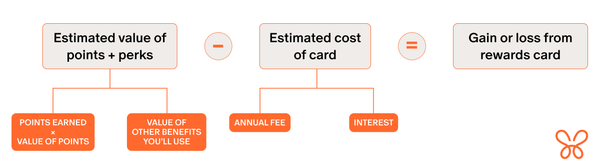

At its simplest, calculating whether a points card is worth it involves subtracting how much a points card will cost you from how much value you’ll get from the rewards. Unfortunately, breaking that down gets a little more complex — you’ll need your calculators for this one.

I should note that, if you plan on paying off your credit card in full every month and are choosing a card with no annual fee, credit card points are a positive bonus no matter what. You can skip the math and move on to picking the card with the best benefits for you!

For the rest of us, let’s carry on.

Calculating the value of credit card points & benefits

To understand how much you’ll get back in value from a points credit card, you’ll want to start by estimating how many points you’ll earn in a year, and how much money those points are likely to be worth.

If you’re thinking of going with a flat-rate cash back card, this calculation is relatively easy: Estimate your annual spending on the credit card (looking at your budget in Monarch can help with that!) and multiply it by the return rate. Let’s say you expect to spend about $2,000 month on a card that offers 1.5% cash back:

($2000 x 0.015) x 12 = $360 back in a year

Unfortunately most cards aren’t this straightforward. Many offer tiered returns based on spending categories. Let’s take one card that offers 3x points on restaurants, travel, gas stations, transit, streaming services, and phone plans, and 1x points on everything else. You’ll want to break out your estimated spending into those categories (again, hopefully you have a budget to help you out!).

(($900 x 3) x 12) + (($1100 x 1) x 12) = 45,600 points back in a year

That sounds like a lot, but next we have to understand how those points actually convert to rewards. As my bank likes to remind me in fine print when I check on my points earnings, “Rewards have no value until redeemed.” And, as Catherine reminded me, “These point systems can and do change often.”

Banks will rarely tell you exactly how much a point is “worth,” partially because that may change over time and partially because the value of points can vary in different programs depending on how you spend them.

For instance, at the time of publishing, Chase’s website explains, “if you have a Sapphire Reserve card and you use your points to book travel through the Chase Ultimate Rewards portal, your points are worth 1.5 cents per point instead of 1. If you have a Sapphire Preferred card, you can redeem for travel at 1.25 cents per point. If you’re interested in cash back, each point is worth 1 cent.”

Again, you could break it down based on how you expect to redeem, or do more of a rough estimation. The Points Guy keeps an updated chart of their estimated valuations per point on various cards, and even has a helpful calculator for common airline and hotel points.

Let’s say I anticipate using my 45,600 points for travel on the Sapphire Preferred card mentioned above.

45,600 x $0.0125 = $570 approximate annual monetary return of points

Finally, you’ll want to look up any other benefits a card you’re considering offers — from credit back for popular streaming services to covered rental car insurance to access to airport lounges — and tally up the value of any you’ll actually use. For instance, just because my credit card offers a $50 statement credit each year for hotels booked through the bank’s travel portal, I wouldn’t count that in my calculations because I rarely book hotels and, when I do, can often find better deals on other sites.

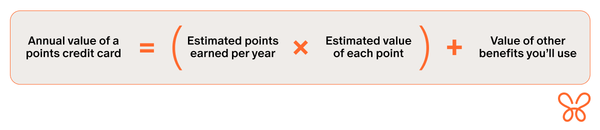

So, to summarize:

Annual value of a points credit card = (Estimated points earned per year * Estimated value of each point) + Value of other benefits you’ll use

Calculating the cost of a rewards card

If you expect to pay off your card in full each month, the only cost of a rewards card is any annual fee (and oftentimes you can call and ask to have it waived). As long as the value you’re getting back is higher than the annual fee, the card is a net positive for you.

If you expect to be carrying a balance on your card, you’ll have to do a bit more “mathematical gymnastics,” as Greg Davis, Office Leader, Pinnacle Financial Partners explains in his blog post on the topic. But the best way to ensure you’re getting benefit from the card (and a solid financial footing) is to pay the card off in full each month.

Summary: Are credit card points worth it?

After all that math, the short answer is that credit card points are usually worth it. “If you’re going to be spending money anyway, you may as well get the points, as long as you’re responsible,” says Catherine.

Make sure you have a handle on your spending and that a high credit limit or chasing rewards isn’t likely to cause you to overspend. Make sure any annual fee or interest costs don’t counteract the benefit you’re getting from points.

And, finally, make sure the rewards you’re earning are ones you’ll actually use. “What are you trying to get out of the rewards that you're gaining from this card? What are your goals?,” asks Andrea, “Do you have a financial goal that you're saving up for? Then a cash back card would help you out. Are you hoping to have more flexibility in how you use your rewards? A points based credit card could be great. If your goal is to maybe travel more than an airline based miles or hotel reward card would be really beneficial to you.”