Sure getting married starts with an “I do” — but one of the main milestones when starting your new life together is combining your finances. And usually that means combining some (or all) of your bank and investment accounts.

If you haven’t thought about your bank account setup in years, don’t worry, the process of combining your financial lives is more straightforward than you might expect. And there’s no “wrong” answer, but there may be a wrong answer for you.

Luckily getting married and pooling your money can be rocket fuel to your financial goals. Consider:

- Those that pooled their money reported higher relationship satisfaction (source).

- Two member households are 15 percentage points less likely to live paycheck-to-paycheck (source).

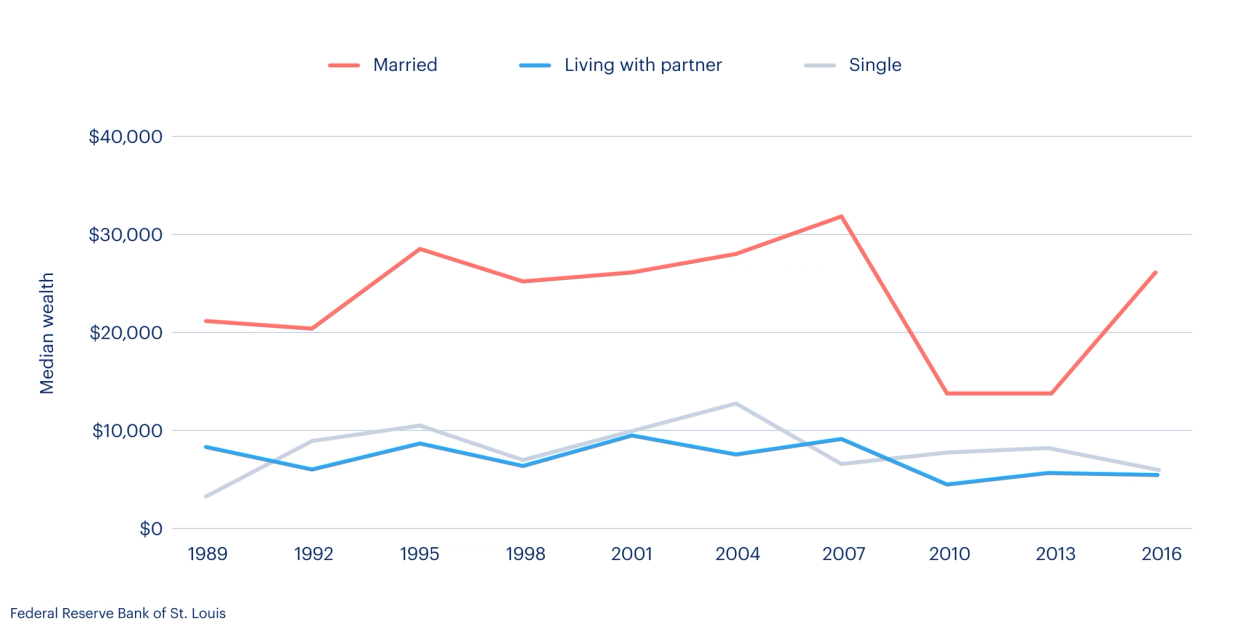

- Married households report a higher median net worth than single households or unmarried couples living together.

So once you’ve decided you are going to combine bank accounts, how do you decide on the best setup for you and your partner?

In this article, we’ll cover the questions to answer before you decide, what the data says other couples do, three options to consider when combining finances, and then a flow chart to help you pick the right option for your household.

Questions to answer before deciding:

To ensure you choose the option that works best for you, it helps to answer some basic questions together as you decide on the right approach.

Are you getting married relatively “late” or “early” in your financial journey?

When you ask a financial advisor for the right approach, this is one of the first questions they will ask you. Those getting married “late” or are not getting married for the first time will likely have accounts and investments that they have spent decades accruing. It can be emotionally complicated to suddenly mix 25 years of retirement savings with your partner’s accounts — especially if there is a mismatch in net worth.

On the other hand, if you are early in your journey or your financial obligations are relatively simple, it’s a more straightforward decision. It’s easier to share your accounts when you know you will be supporting one another as you earn money for years to come.

What are the legal ramifications should you split with your partner?

A difficult question, but it’s an essential one. If you are married, different countries and regions have differing laws that dictate how your assets might be split. 22% of divorces are because of money.

In the U.S., there are nine “community property states” where assets are divided equally between partners. Others are “equitable distribution states” where the court decides the proper split. Additionally, a prenuptial agreement or “prenup” could affect how your assets are divided should you split up.

If you are not married, in most states divorce laws will not apply — and it may be difficult to settle disagreements about shared accounts and property.

Is one partner poised to be the “primary money manager”?

In many couples one person takes the lead in monitoring the ins and outs of checking accounts and ensuring bills are paid on time. 31% of men and 19% of women say they are the primary decision maker for long term planning, according to a 2021 Fidelity survey. If you and your partner decide that one of you will take a more passive role in managing your finances it may be best to combine accounts.

Do either of you have large amounts of debt?

While you may be comfortable splitting shared expenses, do you also want to help pay down any debts your partner brings to the relationship? Should that come from a separate account? Should the person that accrues that debt be solely responsible?

Have you gotten married yet?

If you’re still planning your wedding, paying for it can be an early test for your abilities to split expenses and accounts and thus dictate what you both feel comfortable with after you say “I do”. The average wedding in the U.S. costs $35,000.

Three options for organizing your bank accounts:

While there are endless arrangements of bank accounts and workflows, most couples can slot their set up into one of the three categories below.

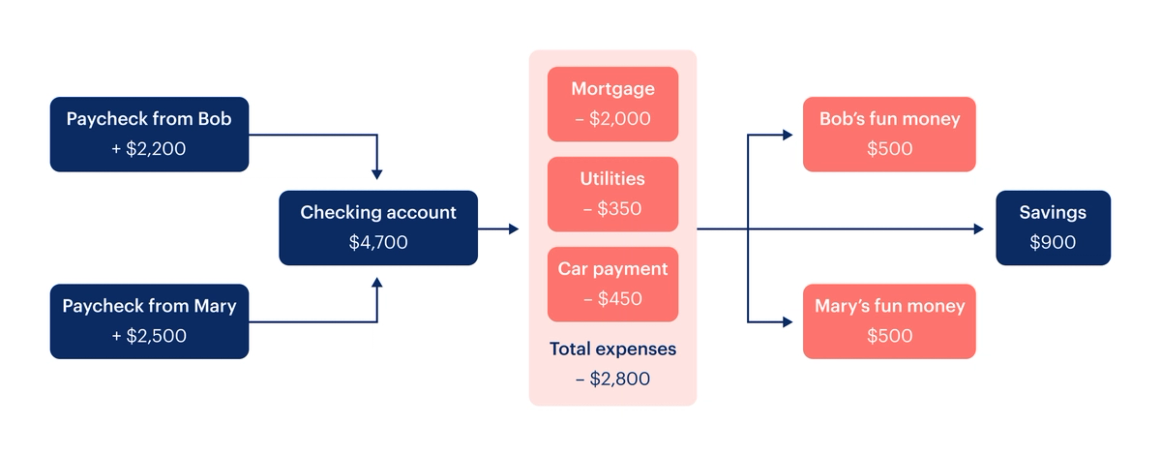

The “All-in” Method

How it works:

- All income no matter its source is deposited into a shared checking account.

- All expenses are paid from the shared account

- A set amount is set aside for each person to use as “fun money”

- The rest is placed into savings

The “All-in” method is the simplest and one that ensures all expenses are paid and that each partner can keep their personal spending on budget. 55% of Monarch users take this approach and "combine everything".

This method is good for couples who:

- …make roughly the same amount of money or aren’t concerned with the appearance that someone isn’t “pulling their weight.”

- …combine finances young or don’t have a complicated financial situation before combining finances.

- …have large fixed expenses they’d like to ensure are paid such as child care or saving for a house.

This method is not the best for couples who:

- …have one member who may not be a conscious spender or who refuses to track their spending.

- …value their individual financial independence. Especially for those getting married later in life, this approach may be extremely disruptive.

- …do not want their spouse to receive some or all of their money if something were to happen.

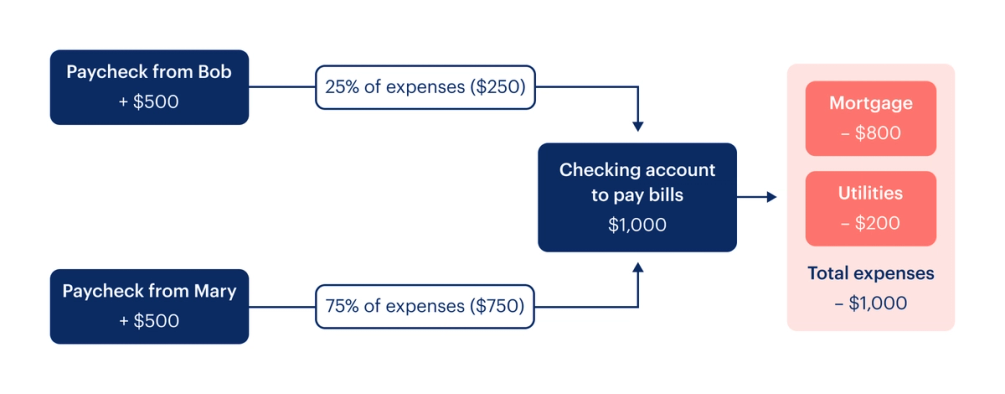

The “Pro Rata” Method

How it works:

- All income is deposited into individual accounts

- Bills are paid out of the shared account, each part contributes based on their portion of earnings (i.e. Bob makes 25% of the income, he contributes toward 25% of the bills)

- The remainder stays in the individual accounts

The “Pro Rata” method maintains some individual autonomy but ensures that the essential shared costs are taken care of. 18% of Monarch users combine at "some" accounts and keep others separate.

This method is good for couples who

- …want to test combining finances slowly.

- …have a large difference in income.

This method is not the best for couples who:

- …are wary of one member may be seen as “not pulling their weight”

- …view marriage as a “two become one”

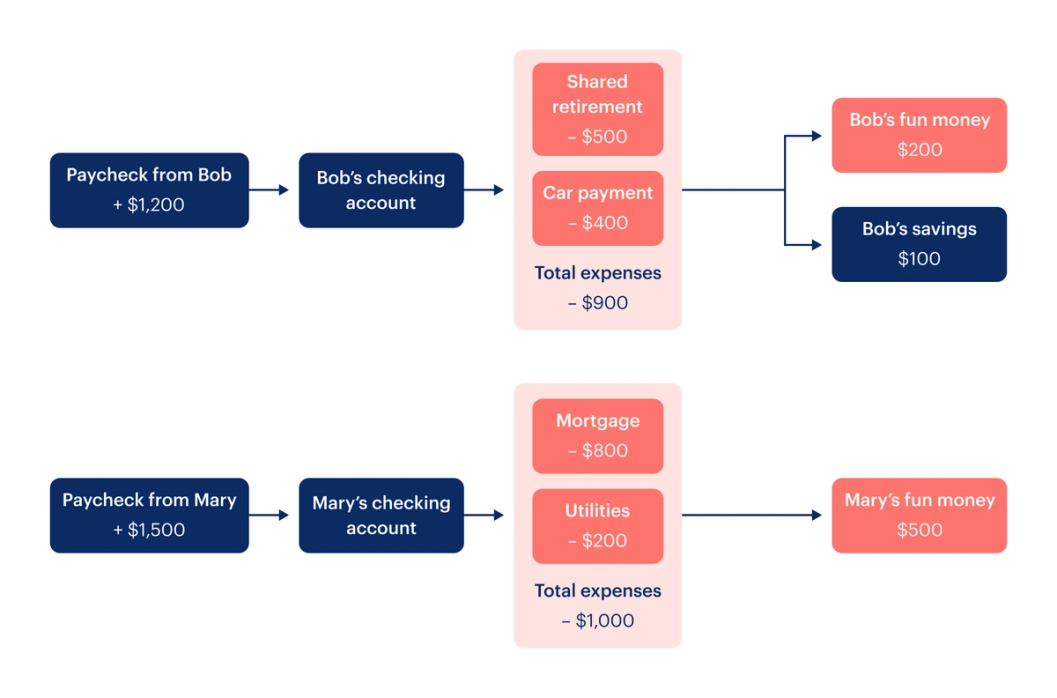

The “Divide and Conquer” Method

How it works:

- All income is deposited into individual accounts

- Each person is responsible for paying 100% certain expenses

The “Divide and Conquer Method” keeps all personal spending separate and ensure that each partner has responsibility toward paying shared expenses. Some couples also include shared investments, like joint retirement accounts. If you do use this approach, make sure your partner is listed on the accounts as receiving ownership should something happen to you. 12% of Monarch users keep their finances separate from their partner or spouse.

This method is good for couples who

- …have no interest in combining finances but still share some expenses.

- …are getting married later in life and would live to keep their previous investments and earnings separate.

This method is not the best for couples who:

- …view marriage as a “two become one.”

- …would shared visibility into how one another are spending their money.

- …have one partner with variable income that may result one one of the utilities not being covered.

- …have trouble communicating about money. This approach takes a great deal of communication to ensure all expenses are covered.

The State of Couples’ Finances

It’s rare one gets to peek into the inner workings of how a couple or household organizes their money. As a result it can be difficult to know where your approach is “normal” and when it is totally unique to you. Luckily there’s some data we can lean on. Some takeaways

- Most couples share at least one account: 75.7% of couples spend money from a shared bank account with a partner or spouse, according to PYMNTS.

- The most common arrangement is the “All-in” method: 65.4% pool all of their finances; 22.5% partially pool their finances; and 12.1% kept all of their finances completely separate according to a 2022 study.

- Younger generations tend to be more likely to have separate accounts. 69% of millennials have at least one separate account versus 51% of baby boomers.

The Types of Joint Accounts

There are various types of account holder rights, be sure that the joint account you open is right for your household.

Who gets what if something happens to one of you is referred to as “rights of survivorship”. There are many types of rights, but the most common for married couples are:

- Joint Tenants with Rights of Survivorship: Both of you have equal rights to this type of account. If one of you passes away, the survivor receives the deceased’s share of the account.

- Tenants in Common: This type of accounts transfer the account to the deceased estate, rather than automatically moving to the spouse or partner. You can also allocate a split other than 50/50 between account holders.

- Community Property: Only available in one of the nine community property states, this account is owned by both partners but if one owner dies the share goes to the deceased's estate.

Tips for opening a joint account:

- Joint accounts are insured for more money than a single account holder. The amount insured by The Federal Deposit Insurance Corporation, is allocated per depositor. So if something were to happen to the account, you’d receive more coverage than if you were managing it alone.

- You do not need to be married in order to open a joint account.

- If the joint account you open can incur debt, like, say, a brokerage account that can trade on margin, you may both be responsible for the debt.

- If your spouse earns little or no income you may be eligible for a Spousal IRA that will allow you both to contribute. You must file a joint tax return to open a spousal IRA.

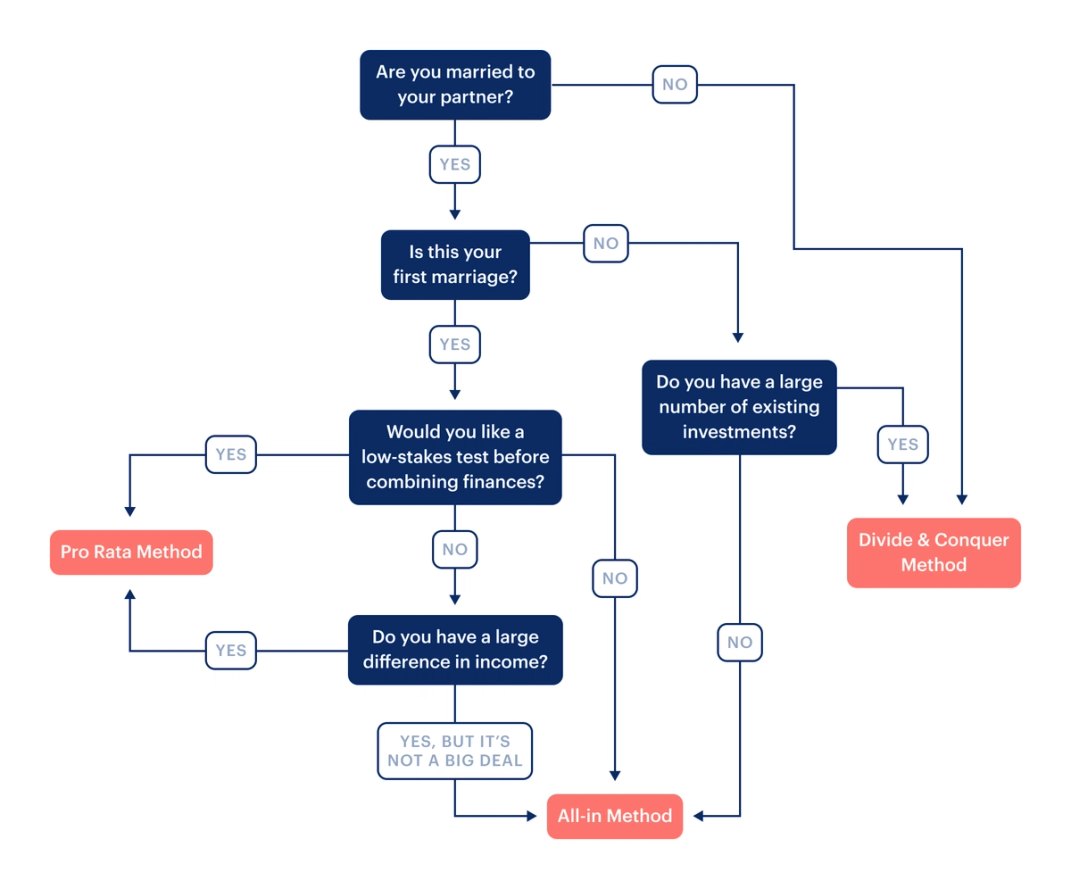

A Flowchart for Deciding

Still undecided on the best way to split your accounts? Here’s a flow chart that may help guide your next financial check-in with your partner.

Conclusion

Combing your bank accounts doesn’t have to be burdensome or scary — it’s a chance to codify what you’ve already decided: that you want to build a life (and a network) with your partner.