Giving yourself a budget is one of the best things you can do financially. It can keep you on the same page with your partner. It can help you be intentional about where your money is going and confident that you’re reaching your goals. But the reality is that traditional budgeting doesn’t work for most people. One study found that 73% of Americans can’t regularly follow a budget.

Fortunately, there’s more than one way to budget. As the head of advice and planning at Monarch, I’ve seen one method work for the vast majority of people over my 20-plus-year career. It’s called flex budgeting — also known as the “one-number budget” or “bucket budgeting.” It’s the most effective method I’ve seen because it’s simple and flexible enough to use it every day. People who have never been able to stick to a budget have told me it’s life-changing.

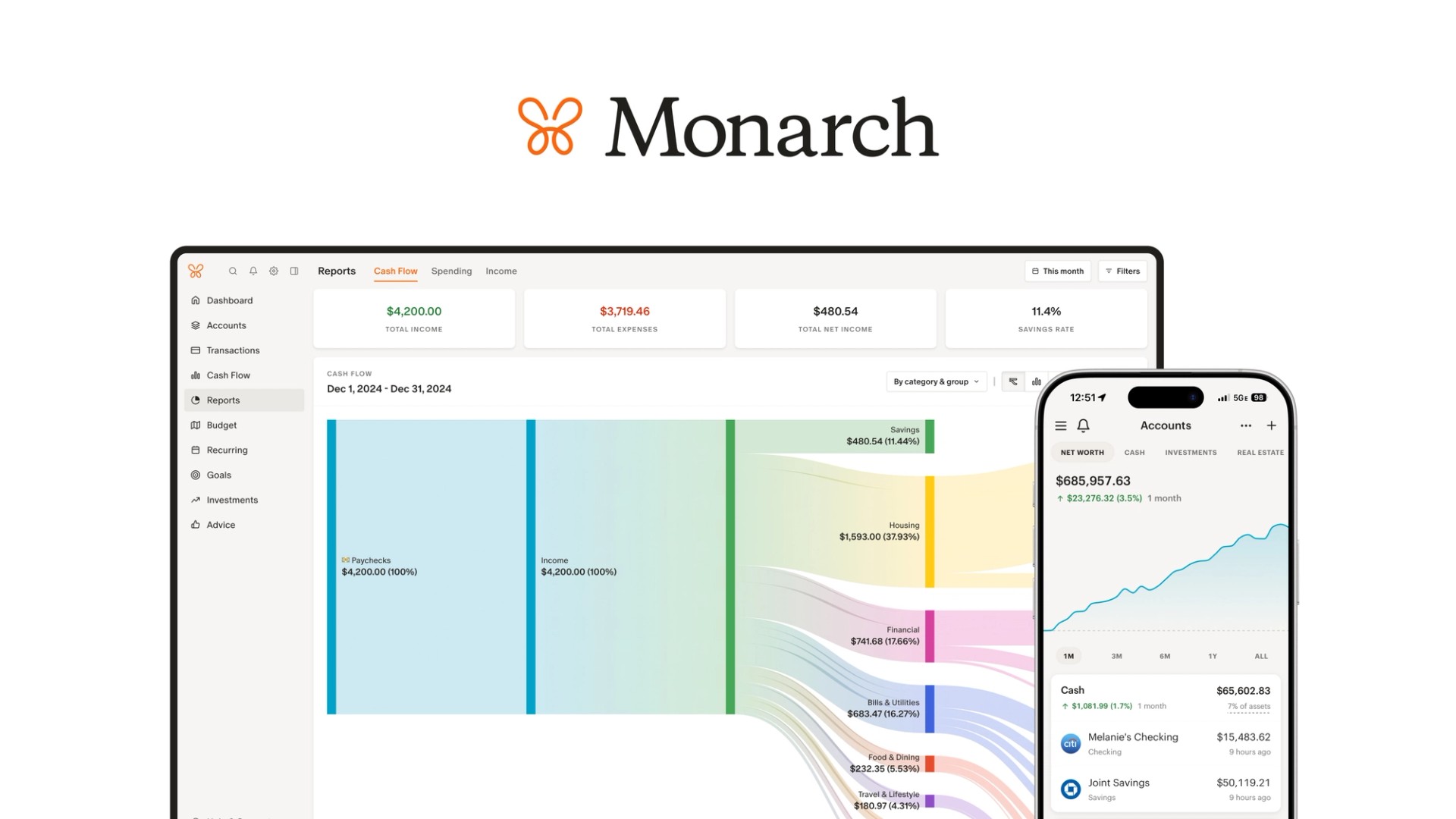

Because it’s so effective, we’ve built it into the Monarch app as one of two ways you can choose to budget. Here’s a rundown of how flex budgeting works and how to set it up so that it works for you.

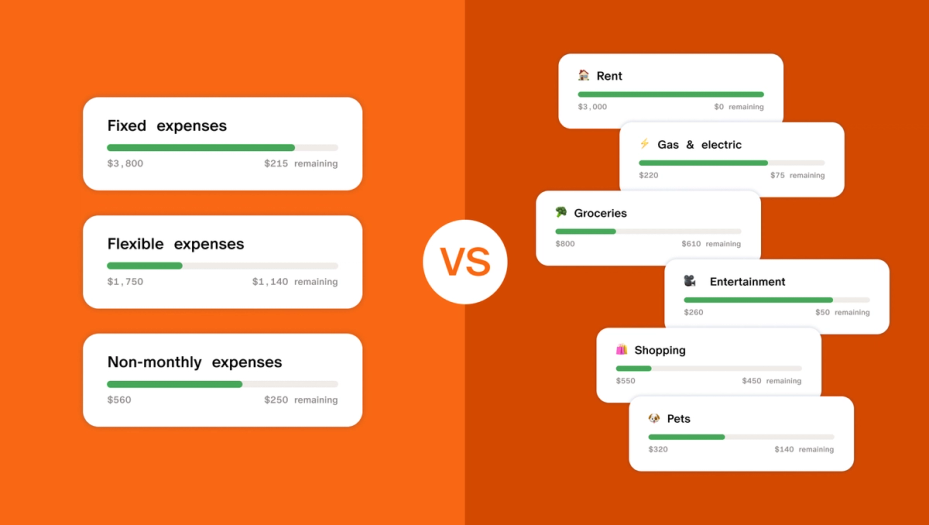

What is flex budgeting?

Flex budgeting is a way to simplify your finances by focusing only on your flexible spending. These are the expenses that go up and down each month, like groceries, entertainment, and restaurants — whether they’re necessities or just for fun. Other expenses, like monthly bills and goals you’re saving for, you can set and mostly forget, because for the most part, you decide in advance how to spend on those.

For everyday spending, you get one high-level number to track. We call this your “flex number.” All you have to do is check your progress toward your flex number throughout the month, and you’ll know if you’re on track or if you might want to adjust your spending.

This is unlike traditional budgeting, also known as “category budgeting.” With that method, you assign every expense category a budget and track your spending toward each budget. This includes all your expenses, not just the ones that go up and down each month.

Why flex budgeting is easier

Category budgeting takes a lot of mental effort: You have to match each expense to a category and track them all. Then, you need to go back each month to see if you hit your spending goals or went over them. You may not even know you overspent until after the fact.

Flex budgeting reduces that effort down to a single spending number. It’s a proactive way to make a split-second decision before you spend: All you have to do is look at your flex number to see how you’re doing.

And here’s the interesting thing: For most people, flex budgeting works as well as category budgeting — even though it’s less work. That’s because budgeting isn’t a precise exercise. It feels like it is because it's numbers and it's math. But if you get overly precise with it, it's going to change tomorrow anyway.

How to set up flex budgeting

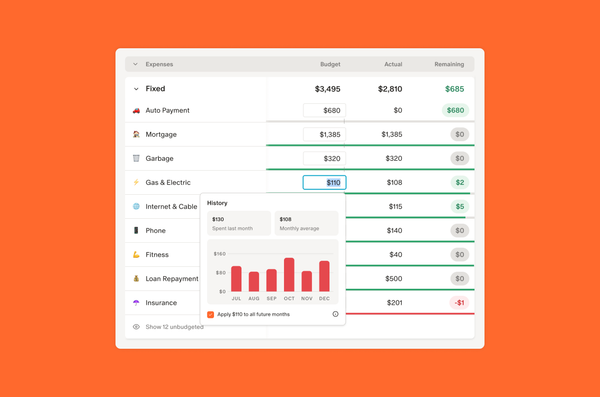

To get started, go through all your expenses over the last three to six months and sort them into high-level spending buckets. This can take time if you’re doing it manually, but Monarch automatically sorts each transaction into its most commonly used bucket and calculates your historical spending as it comes in. All you have to do is make sure everything looks right.

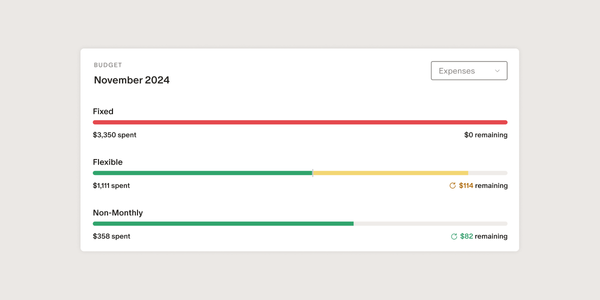

You’ll sort each expense into one of three buckets: fixed, non-monthly, and flexible, and then allocate some money to your goals.

Fixed expenses

Your fixed expenses are your most predictable, since you pay them each month. The amounts might vary a little — like electricity, phone, or subscription boxes — or stay the same, like your rent or mortgage.

- Rent or mortgage

- Monthly insurance premiums

- Minimums on your loans or other debts

- Gym memberships

- Subscriptions of all kinds

- Utilities

- Phone

- Automatic monthly donations to charity

- Childcare

Non-monthly expenses

These are the bigger expenses. You know they’ll come at least once a year, but they either don’t happen every month or vary widely from month to month. They’re also often known as “sinking funds” or “irregular” or “periodic expenses.” Common non-monthly expenses:

- Taxes

- Gifts

- Getting your car worked on

- Home repair

- Travel

- Annual donations to charity

- Annual subscriptions

- Annual or semiannual insurance

Flexible expenses

These are the expenses that are hardest to predict, but easiest for you to control. You could pay more or less for them in a week or month; or you can even go without some of them.

Some of your flexible expenses are needs (like groceries) you'll probably have to buy each month. Others could be things you want but didn't budget for anywhere else. If you have a big unplanned expense that isn’t an emergency and can't be covered by savings, try to cover it with flexible spending. Common flexible expenses:

- Groceries

- Gas

- Medical copays

- Shopping

- Restaurants

- Entertainment

- Hobbies

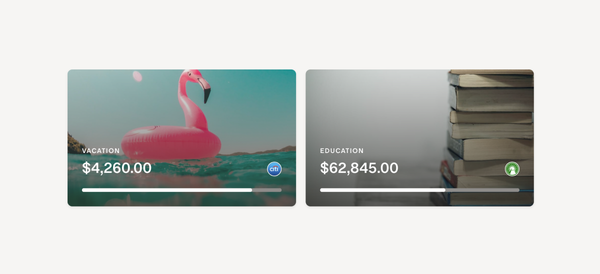

Goals

While goals and non-monthly expenses can both be big and unpredictable, they’re different. You know you’ll have non-monthly expenses at least once a year, but goals are typically the bigger life targets that you’ll need to save or invest toward for a while. I’ve found that sticking to your flex number helps people save more every month toward their goals — and meet their targets faster.

Common goals:

- Setting up an emergency fund

- Investing to grow your net worth

- Retiring early

- Paying down loans beyond the monthly minimums

- Buying a house or car

- Paying for education

- A big vacation

How to come up with your flex number

1. Estimate your monthly income.

This will be easier if you’re a full time salaried employee and a little harder if you have variable income: hourly, self-employment, or heavily commission-based. If you’re in doubt, go with a conservative number and build your budget from there. It’s better to have more left over than not enough.

2. Subtract your fixed and non-monthly expenses from your income.

This gives you a pool of money you can decide to spend or save for your goals. Monarch does this automatically for you as you set up your Flex Budget.

3. Review your future goals.

Your three expense buckets are important, but so is saving for your bigger financial goals. You’ll want to try to preserve some money from your income to put toward those. You can explore and prioritize your goals any time in the Goals area in Monarch. After reviewing your expense buckets, you may have extra money left over that you can put toward your goals. If not, you might want to see where you can cut some spending, or reprioritize some goals for now.

4. Keep an eye on your flex number as you make your day-to-day spending decisions.

Once you’ve reviewed your goals and feel good about your budget, your flexible budget is the one number to focus on for day-to-day spending. You can divide it by 4.3 to arrive at a weekly amount if you want; weekly is an easier time frame for most people to stick to.

An example of how flex budgeting works

Based on the income and transaction history you give Monarch:

- Your average take-home pay is $5,000 a month.

- Your average Fixed expense spending is $2,550 a month.

- Your average Non-Monthly expense spending is $350 a month.

That leaves $2,100 a month you can use for Flex spending or towards your goals.

According to Monarch, your average Flexible expense spending is $1,300 a month. You review your goals, where you’re committing $500 a month right now.

Now you have a choice: You may decide you want to add $300 to your flex number. Or you could put more money toward your goals. Or you might put it somewhere else that makes sense for your lifestyle.

A few things to consider

Give yourself time to set it up and adjust

While Monarch makes it easy by automatically analyzing your transactions and sorting them into fixed, non-monthly, and flexible buckets, you’ll still want to review here and there and adjust as you get familiar with this method. You might consider some expenses more flexible than fixed, or vice versa. For example, some people prefer to put groceries and gas into their fixed expenses — their habits are consistent enough that there’s not much variation and they can treat them more like utilities.

You might also need to create a new category when different expenses within the category can fall into different buckets. For example, you could make a Charity (monthly) category for recurring monthly donations and a Charity (non-monthly) category for annual donations.

Stay on top of your needs vs. your wants

While flex budgeting is simple, you still need to stay aware of what you need to spend on. To some people, one number might not be specific enough to help them remember everything they’ll need to purchase weekly or monthly. If that sounds like you, try setting budgets for the categories inside your flexible expense bucket in Monarch. You’ll be able to spend however you want toward your flex number, but seeing those specific budgets can act as a spending guideline.

Try separating your flex money

One way to make flex budgeting even easier is to actually separate out your flex money. This makes you much less likely to overspend your flex number. We recommend that you create a new no-fee checking account with its own debit card. Set it up so that your flex number is automatically transferred once per week.

You could also consider withdrawing your flex spending in cash (if you mostly pay cash) or adding your flex number weekly to a prepaid debit card with low or no fees. You could even use a separate regular credit card for flex spending, but only if you’re prepared to closely track that number since it’s easy and costly to overspend on credit cards.

Unstable income is less simple to track

If your income is variable, you’ll need to estimate your annual earnings. You can do that in one of two ways:

1. Project your annual income based on what you’ve made so far this year; this works best if you have a good sense of what you’ll make based on a longer work history, but you can always re-evaluate it quarterly or monthly to make sure it’s accurate. The more variable your income, the more frequently you’ll want to revisit and tweak.

2. Use your average spending across all your spending buckets to set a target for your net income (after taxes and any business overhead). This works best when you have control over how much or little you earn by taking on extra contracts, clients, or shifts.

Non-monthly expenses might throw you off

Since life often brings along bigger but irregular expenses, we recommend getting a good sense of what your non-monthly expenses will be, then adding in a little extra to give yourself wiggle room throughout the year.

To do that, look backward at the last 12 months to see what came up, then forward over the next 12 months to understand if anything new might come up. You can average out how much you need for individual categories or give yourself a top-level budget for all your non-monthly expenses.

Then, when setting up your budget, bake in more than you think you’ll need. If you don’t spend it all, the extra money automatically rolls over into future months.

You may need to cut back your spending

If your fixed and non-monthly expenses don't leave enough for your flex spending (and goals, on top of that), you'll want to think about where you’d feel comfortable cutting back.

It’s easier to cut fixed expenses first, because they’re more predictable and you’ll save every single month. You can start with the things you don’t need, like subscriptions. But if that’s not enough, you can get creative about cutting the bigger fixed expenses by taking on a roommate, renting out living or storage spaces, or refinancing your debt.

Review every few months

Often, people decide to set more money toward their goals as they begin to understand their spending better — especially if they have shorter-term goals like paying down high-interest debt or buying a house in the next few years.

If you’re in a relationship, I always recommend a monthly financial chat. Flex budgeting is an easy way to talk about spending and make sure you agree on your goals and priorities. Review at least monthly if you have unstable income, and again any time your finances change — be it something great like a promotion, or something critical like a layoff.

Once you’re comfortable that everything’s humming along, you can settle into a quarterly review. Every few months, go over your spending in all of your buckets. Review the priority of your goals and your progress toward them. You might also want to make adjustments for outside reasons, like recent policy or market changes. Make sure your spending still looks and feels good.

If it feels good, you’ll use it. And when you use it, you’re one step closer to being intentional with your money and building the life you want.