Advice

There is a whole new section in Monarch (web only for now) called Advice. We've always felt that advice is a missing part of most personal finance apps so we're excited to offer this new type of feature. You can answer a few questions to start getting recommended advice and we plan to add more advice over time. Read more about our thoughts on financial advice on our blog.

Keep track of your home value automatically

You can now track the value of any property you have using Zillow. You can even convert an existing property you have in Monarch to a synced account and the value will be updated each month. Converting an existing property is live on web, and included in the next version of the mobile apps.

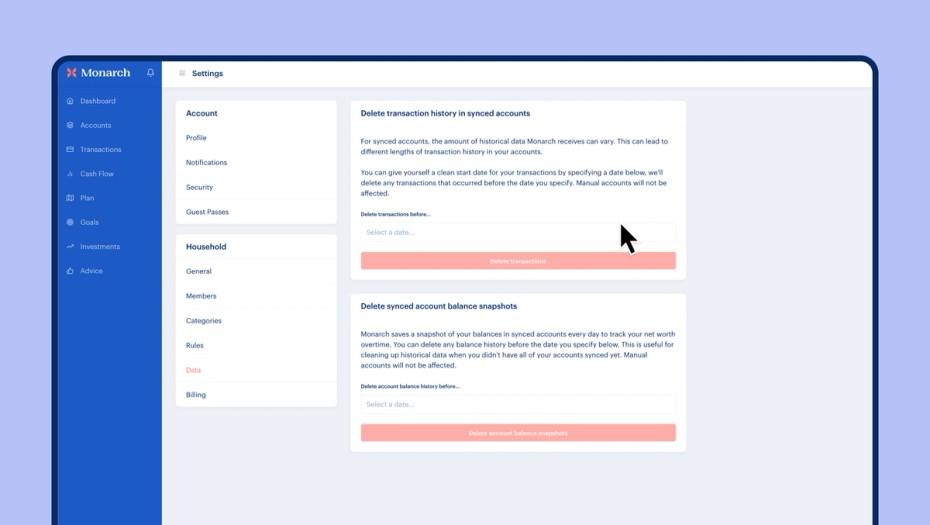

Start Date for Transactions and Balances

When connecting your accounts to Monarch for the first time your account may only provide transactions back for the past 1 month or up to 2 years. This can make it difficult if you have a ton of uncategorized transactions or want a good clean start date where everything is accurate going forward. This new settings page called Data allows you to set a start date for both transactions and account balances so you can get off to a fresh start.

Investments leaves beta

Back in May we launched a beta section for Investments and after getting more feedback we've made a series of changes to make it even better:

- The date picker now lets you go back much further in time, up to 3 years, so you can track your investments over the long term

- The Nasdaq benchmark card was swapped for US Bonds so there is a wider variety for comparing your holdings against the overall market (S&P500), US Stocks, or US Bonds

- The table showing holdings has been simplified to show the change over time, quantity, current price and total value

We have lots of future plans for making investments even better by adding features like asset allocation, time and money-weighted rates of return, fee analysis, and general portfolio risk vs reward (the efficient frontier)!

Other improvements

- The mobile app now has many of the transaction filters that were only on web before (filter by amount, date range, hidden, splits, notes, attachments and merchants).

- On web, we added a new dropdown menu on transactions so you can sort by amount (vs just date).

- Transaction rules can now hide transactions. Hidden transactions are hidden from your Plan and Cash Flow calculations but still show on the Transactions page.

- Fixed an issue in the mobile app where hidden accounts were being included in the account type sums. For example, if you had a hidden loan account, then the amount of the hidden loan would still be included in the sum of all your loans on the page. Note that this issue didn’t impact net worth calculations.

- You can now invite household members using the mobile app (previously was web only).

- Hidden accounts are now collapsed on the Accounts page.

- Our customer success team can now provide links to other data providers if you have connection issues with your accounts.

What's Next

- We've started to build a solution to allow categories to rollover the remaining budget amounts. This should allow you to save for non-monthly expenses, large purchases like vacations, annual budgeting or just carry a remainder forward if you over or under spend a budget category.

- We're putting the finishing touches on the ability to mark an account as "closed" or inactive which will allow you to hide it from the accounts view and stop syncing new transactions but retain all transactions and history.