Rollovers

Sometimes you know exactly the amount you want to budget for a category: rent, mortgage, or even Netflix. Other times the budget is an approximation, you don’t know the exact dollar amount in advance: restaurants, groceries, or entertainment. For those approximate categories you can now turn them into rollover budgets. A rollover means that any budget left at the end of the month will carry forward into the next month. There are all sorts of use cases for this:

- Non-monthly expenses: Seasonal categories like clothing (fall and spring), books or tuition (each semester), or kids activities (summer camp!) may have the bulk of their spending in a few months and little/no spending in others. By turning rollovers on you can either budget to save up for them by rolling over a surplus each month or pay them down by rolling over the deficit each month.

- Yearly budget: Take your annual budget amount for the category and divide by 12. You can then track if you are over (negative rollover) or under (positive rollover) the average for the year each month. At the end of the year the rollover amount can be reset back to zero.

- Sinking funds or short-term goals: Create a new custom category for a goal with a budget amount you wish to “save” each month. When you don’t spend in that category the remaining rollover amount keeps growing until you’re ready to spend it. This also works in reverse - if you create a new custom category for a goal and spend from it without saving you can pay it down by not spending in future months until it gets to zero.

Referral Rewards

We’ve redesigned our guest pass system to make it easier to share, and have introduced rewards as a thank you for sharing Monarch.

- Earn $9.99 in credits for every paying user you refer: You’ll receive these credits automatically when someone you refer pays for Monarch, and there’s no limit to how many credits you can earn.

- One unique link for your household: Each household now gets one unique link they can share anywhere, instead of having to generate a new link each time. Visit the referrals page now to copy your link or share it on social media.

- People you invite get a 30-day trial: Our typical trial is currently 7 days, so this gives the people you refer an extended time to try out Monarch.

- We’ll be giving out credits for past referrals: If you used the old guest pass system and someone you invited paid for Monarch, you’ll be receiving credits in the next few days.

- Billing restrictions apply: We’re not able to offer credits to users that are billed through the App Store or Play Store due to those platform’s billing restrictions, but you can easily switch to web billing by following this help article. Once you switch, you’ll be eligible for credits.

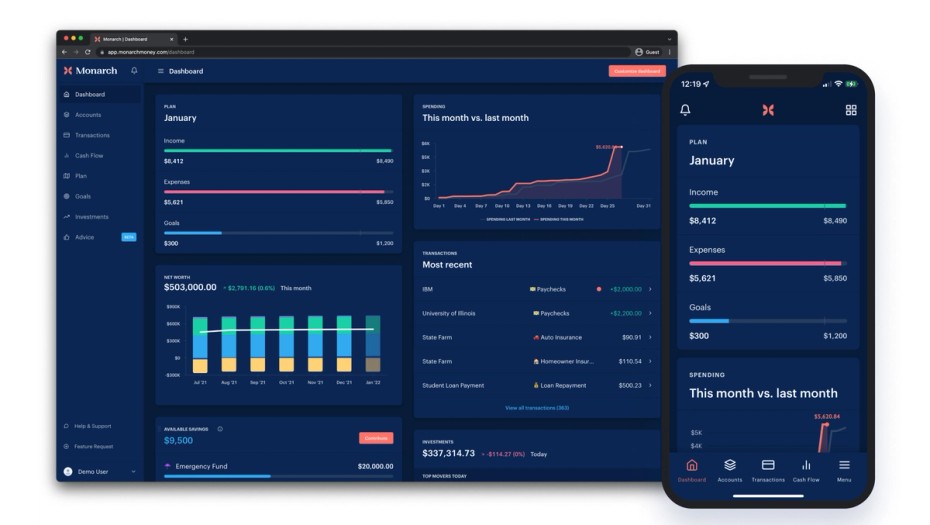

Dark Mode

Monarch now has a dark mode! You may have noticed it already depending on your system preferences. Check out Settings → Preferences → Visual Appearance to change Monarch from light to dark. You can also set it to “System Preference” if you prefer to have Monarch match the OS settings.

Other Improvements

- Fixed a bug where the Top income and Top expense category screens were missing from the monthly review

- Fixed a few bugs with CSV formatting that prevented some people from importing Mint CSV’s

- Added commas to a few places that were missing them when showing large numbers

What's Next

- Investments on Mobile: We’re currently building the investments feature on mobile, which will have all of the same functionality that exists on web today.

Top 4 Fintech App @ Product Hunt

How to pay off credit card debtWe’d like to thank everyone who voted for Monarch in Product Hunt’s yearly Golden Kitty award. Monarch was nominated for best new Fintech app and we made it to the final 4!