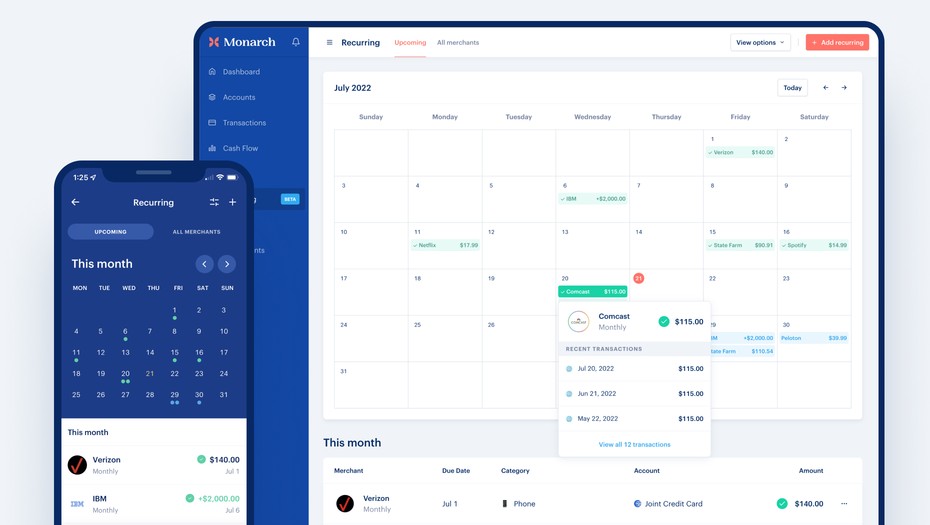

Recurring

There is a whole new section launching today in Monarch called Recurring. The new recurring section scans your transactions and finds any bills or subscriptions that happen on a regular frequency. This can be everything from mortgage payments, rent, utilities, insurance, memberships, donations, subscriptions etc. It even works for transactions beyond expenses like your paycheck or scheduled transfers to invest or save.With this new section comes lots of additional features related to it:

- A new monthly calendar view to plot out upcoming transactions for the current month

- Confirm when a recurring bill or subscription has been paid on the calendar with a green checkmark

- Navigate to future (or past) months to view all recurring transactions in that month

- View a list of all recurring merchants and filter or group by their frequency, category, account or amounts

- Recurring streams are automatically detected when Monarch receives new transactions from your banks or credit cards

- Notification (push or email) 3 days before a recurring transaction is expected

- Trigger a manual scan of your past transactions to find recurring streams

- Manually add a new recurring stream - either from a single transaction or from scratch

- Logos are now shown on transactions - use the defaults or upload your own

- A new merchant management page to manage all merchants - scan for duplicates and merge/delete them

- New system to more accurately cleanup statement text (ie “WHOLEFDSMRKT” → “Whole Foods”)

- Timestamps on the last time a rule changed a transaction (coming soon) to help cleanup old rules that may not be needed with the better logo/merchant name cleanup

We’re labeling this feature as “beta” for now since we’d love feedback on how well it does at detecting your bills and subscriptions. We also are looking to integrate the new recurring section with the cash flow and budget sections so look for future improvements as recurring makes its way into the rest of Monarch.

Other Improvements

- The new filters released for the cash flow section last month are now available for individual accounts. You can filter or search for transactions inside an account by keyword, category, merchant, amount or tag similar to the transactions or cash flow sections

- Some investments don’t have historical info so they now have a ⍉ symbol next to them with a note on the investment graph that their info is not included in the calculations (we’re working to replace any missing info particularly for mutual funds)

- A few stocks that recently had stock splits or name changes (Amazon, Nvidia, Google, Meta) now have accurate historical info and current prices

- The investment graph on the mobile app has more space and a dotted 0% line so it’s easier to read

- When changing a monthly budget amount the “apply to all future months” is automatically checked now so the change gets applied going forward based on the average of the last 3 months

- Tags are now included as a comma separated list in the CSV export

- Venmo accounts can now be force refreshed

- Added a new connection for Square’s Cash App

- Added new connections for a few more crypto exchanges - Binance, Kraken and Gemini

Bug Fixes

- Fixed a bug in the Mint CSV import flow where some transactions were not importing

- Fixed a bug where the Android app was crashing for some customers

- Fixed a bug when creating manual transactions in loan accounts, it was showing an incorrect preview of the new account balance

What’s Next

- iOS Widgets: Should be released very shortly! The first 3 widgets will be for budgets/categories, transactions and investments.

- Manual Holdings: A new way to track investments without requiring a username or password. Pick from any investment security and enter a quantity and purchase date to track the real-time portfolio value. Will work with any cryptocurrency or market traded security (stocks, bonds, mutual funds, ETFs etc).

- Goals: Overhaul to the goals section to map real transactions and balances to specific goals and forecast them.