It’s a phrase that strikes fear into anyone who’s gainfully employed: Layoffs are coming! Whether it’s chatter in your organization or industry-wide cuts that have you worried, having advance warning can actually be better than being blindsided with a sudden and unexpected shock.

Forewarned is forearmed, and with a little effort, you can set yourself up to weather the storm in the best financial shape possible. Being proactive can help protect your finances, career, and even your lifestyle, so the change impacts your quality of life as little as possible.

Learn more about how to prepare for a layoff and loss of employment before it happens, to turn misfortune into opportunity.

How Do Layoffs Work?

A layoff is when a company decides to scale back or restructure its workforce. The impacted employees are usually told at the same time, and severance packages may or may not be offered. The difference between laid off and fired is that getting fired is usually tied to an employee’s job performance.

First: Prep Your Finances

Going into panic mode — and then debt — is the post-layoff game plan for many, but it doesn’t have to be that way for you. Follow these strategies on how to financially prepare for a layoff and stay cool, calm, and collected in the face of a cash flow interruption.

1. Bulk Up Your Emergency Fund

If you haven’t been diligent about saving, it’s time to get serious and do some catching up. With a layoff looming, you’ll want to build up to at least three months of take home pay to start. If you’ve got a mortgage and/or kids, then aiming for six months of take home pay (or more) is even better. Getting whatever you can in place now can give you peace of mind as you ramp up your job search, giving you time to find your next role.

2. Create a Laid-Off Budget

“Wait, I stopped budgeting years ago!” If it’s been a while since you did a full accounting of your money coming in and money going out, it’s time to get back to it. With a good-paying job, you might have gotten lax or forgotten what it felt like to put off purchases. You may not be accustomed to making sacrifices to afford expenses.

But — it’s important to retrain yourself to track your spending. Start evaluating each line item to see if there are areas you can cut back on for a while. You don’t have to sacrifice everything, but limiting your take-out lunches, scaling back your streaming subscriptions, and pausing your gym membership lets you stash money that you may need to tap into later.

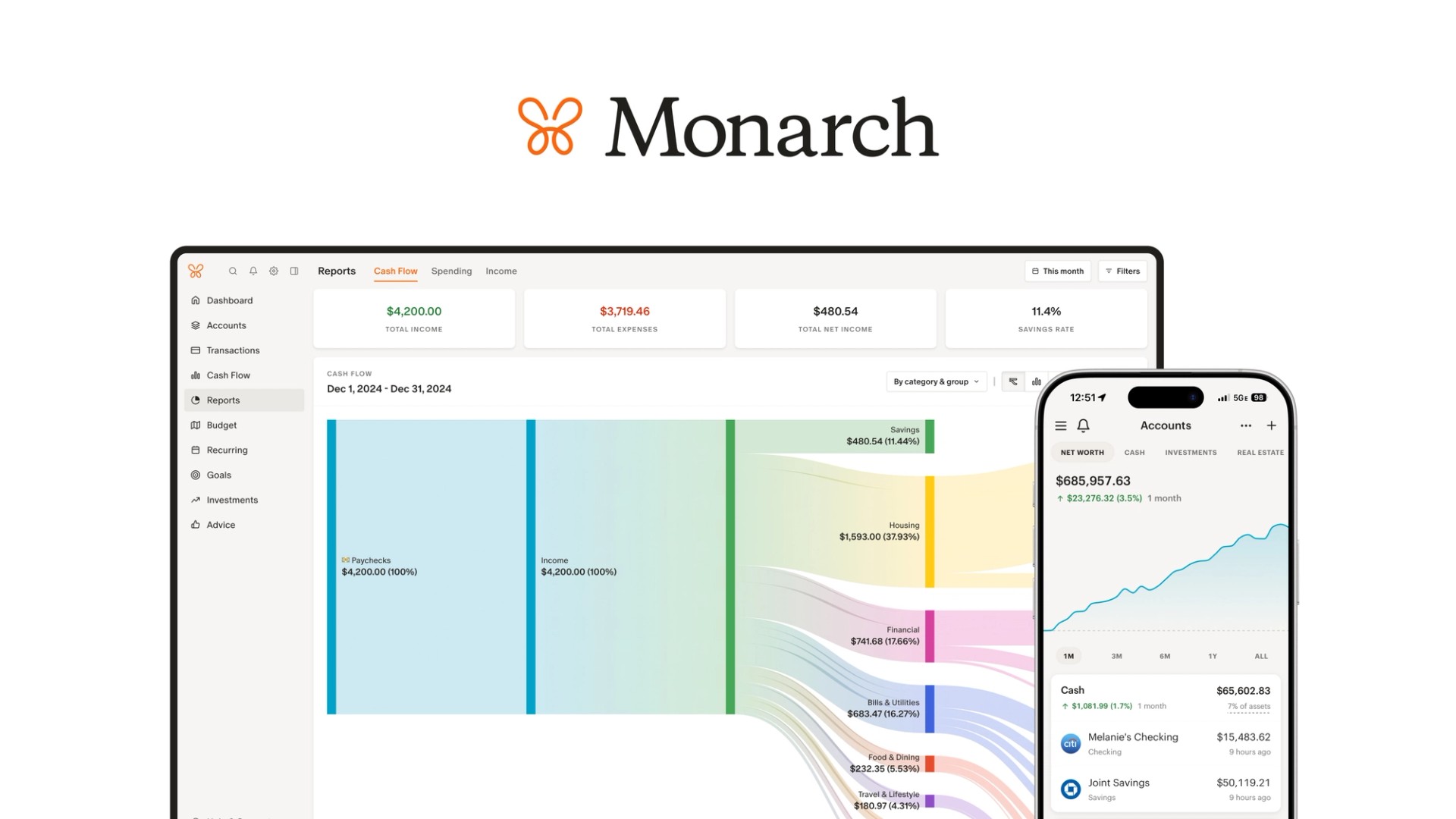

Or — make it easy on yourself by using an app to do it for you. A budgeting tool like Monarch Money can help you see all your money in and out at a glance, so you can gain control of your money without adding stress to your day.

3. Avoid Large or Unnecessary Purchases

“I really could use a new computer, especially if I’ll be looking for a new job.” While that might seem like a good idea, if you might be getting laid off, it’s probably the worst time to start dropping hundreds or thousands of dollars on items that aren’t necessities.

4. Investigate Other Income Streams

Besides reducing expenses, the other main way to prepare your budget for a layoff is to try to increase your income. Depending on how much free time you have, you could consider picking up some freelance work.

Or perhaps you have a garage full of items that you’ve been wanting to sell. This would be the perfect opportunity to set aside a weekend for a garage sale or to post items for sale online.

5. Apply for a Credit Cushion

The last thing you want to do is run up your credit cards after getting laid off. However, there is some value in knowing that you have a line of available credit should your savings start to dwindle. The best scenario is if you can borrow interest-free. If you have good credit, you can do just that.

First find a credit card with a long introductory offer of 0% APR. The key is to apply before you get laid off. That’s because, once you lose your income, you may not qualify for that card. Some intro offers last for 18 months or longer. With this strategy in place, if you do find yourself in a cash crunch and need to use the card, you’ll hopefully be employed again by the time interest rate kicks in.

Second: Gather Info

You’ll have a lot of emotions to deal with if the day comes that you get laid off. Thinking through some of the details in advance of a layoff can arm you with knowledge and information so you know what your next steps are.

6. Learn Your Rights

Remember that employee handbook that you haven’t looked at since you were hired? Take a pass through it to get a sense of what your employer promised about unused sick and vacation days. How are those paid out in the event of a layoff? You should also research if there are any state laws regarding how vacation time is handled if you’re let go.

7. Read up on How Unemployment Works in Your State

One saving grace of getting laid off is that you may be eligible to collect unemployment. This extra funding can help get you through as you look for a new opportunity. But each state has its own process and set of rules around eligibility and approvals. Knowing that information up front can help you get your application in quickly. That can help you start receiving assistance faster, when everyone else is just starting to flood the system.

8. Get the Scoop on Stock Options

If you have equity compensation, like RSUs or stock options, find out if there may be any accelerated vesting. Also consider whether it makes sense to exercise vested stock options in the event of a layoff.

In most cases, you’ll have a 90-day window (called the post-termination exercise, or PTE, window) to make your stock option decisions, so it’s not something you want to put off. Because this can get complicated, you may want to speak with your financial advisor or accountant to be sure you understand your options, and potential tax consequences, in advance.

9. Create a Paper Trail

Some employers take precautions when they’re handing out layoffs, like cutting off your access to email, the company intranet, and portals where your important documents might be located.

So — while you still can, download your YTD pay stub and any other documents from your HR portal. You may need your pay stub in hand before you can file an unemployment claim, for example, and it will be easier if you already have it.

Third: Guard Your Health

Worrying about how you’ll afford health and medical care can be one of the most stressful aspects of being laid off. Take steps now to put yourself in the best possible position to get healthy in case of a future lapse or decline in coverage.

When was your last checkup? Do you take prescription medication? If you haven’t been on top of your health, start making those appointments now while you still have coverage.

10. Make Your Doctors and Specialists Appointments ASAP

Take the time to find out when your last checkup was, and whether you are due for diagnostic exams. Take care of those appointments now, so you don’t end up having to pay out-of-pocket later.

11. Stockpile Your Meds

If you take prescription medications, see if your health plan allows you to order three months' worth at a time, and place an order. And if you’re due for a new prescription, get in touch with your doctors now to expedite that process.

12. Don’t Forget About Your “Use it or Lose it” FSA Dollars

If you have any remaining FSA and dependent care FSA dollars, start using them up on co-pays, dental visits, over-the-counter medications, and medical supplies that you may need in the coming months.Also worth noting is that you’re entitled to the full amount of FSA funds you elected for the year (while still employed).

So — say you paid out of pocket for a medical bill early in the year. You can request reimbursement up to your total elected amount, even if you haven’t yet contributed that amount. Then if you’re laid off, your employer must cover that difference.

13. Figure Out a Backup Plan

If you’re partnered, research the process and the costs for getting added to your partner’s employer benefits. You’ll usually have to do this within 30 days of your last day of work (known as the Qualifying Life Event, or QLE, window), so knowing the application process in advance can help move things along.

If you can’t get added to your partner’s benefits, you’re entitled to keep your employee benefits for 18 months if you pay for them yourself through COBRA — as long as your company employed at least 20 people in the previous calendar year. You must apply within 60 days of your last day of work, or you can choose to enroll in the healthcare marketplace, which could end up being less expensive.

Fourth: Prep Your Candidacy

Especially if you’ve been with your company for a number of years, there’s a good chance that your career materials need a refresh.

14. Update Your Resume

List out all of the key accomplishments and skills learned at your current job, including quantitative data to highlight your contributions.

15. Research Trends in Your Career Field

Are widespread layoffs coming in your industry? Or is it just your organization that is restructuring? Understanding the current climate can help you decide if you should branch out into other sectors.

16. Study Job Descriptions

Take a look at what employers in your field are expecting from their job applicants to see if you need any new training or credentials to be competitive.

17. Update Your LinkedIn Profile

Like your resume, if your LinkedIn profile is a bit dusty, polish it up with some updated career highlights.

18. Get Back to Networking

Have you lost touch with former colleagues? Reach out with a friendly note and reconnect. At the same time, try to expand your professional network by attending local meetups and industry events, and joining relevant groups and discussions online.

19. Build Proof of Skills While You Can

Gather samples of your current work, and create a file with your contacts, just in case you lose access to those items in the event of a layoff.

Fifth: Front Load Your Job Search

Conventional wisdom says it’s easier to find a job while you’re still employed. And if you’re worried about getting laid off, there’s no reason to put off looking.

20. Visit Job Search Databases

Download popular job apps like Indeed and Monster, and scour LinkedIn postings to get a sense of what’s out there. Flag opportunities that seem like good potentials, and once your resume is updated, start firing off some applications. Google for Jobs is the #1 job site on the web, but you can also try career-specific job boards in your niche, like Engineer Jobs or the Physician Job Board, and The Ladders for openings in high-paying professions.

21. See What Your Contacts Are up To

From former colleagues and clients to fellow alumni, create a list of people who you’ve had a good professional or personal relationship with to see where they’re working and if those companies are hiring. Referrals can be a much more effective way in through the door than a cold call or an email.

22. Spread the Word

You don’t want to publicly announce that you’re looking for a new job. (That could put you on the employee chopping block earlier.) However, you can start letting people outside of your office know you’re in the market for a new role. You never know where your next lead may come from, whether it’s your neighbors, friends, extended family, or the parents of your kids’ classmates.

Why Are Tech Layoffs Happening?

Big tech layoffs have been blamed on worries over an impending recession, and a desire to scale back workforces after over-hiring during the pandemic. Major tech company layoffs include:

- Amazon layoffs: 18,000

- Google layoffs: 12,000

- Meta layoffs: 11,000

- Twitter layoffs: 5,000

- Microsoft layoffs: 10,000

The list above shows announced tech layoffs as of February 1, 2023.

Be Financially Prepared, Always

Even if you don’t suspect a layoff in your future, you can prepare yourself for potential job loss and financial threats by keeping your finances organized with Monarch Money. Unexpected things can happen any time, but information is power. Knowing how to deal with being laid off is just one benefit of having a financial plan in place with intuitive software. With the right plan, you’ll be ready to handle anything that comes your way.