What’s New

We're always working on new features and improvements. Check back here for the latest updates to Monarch.

February 26, 2025

Your favorite reports, now one click away

Now you can save your favorite reports for quick access. Plus a number of other improvements!

December 12, 2024

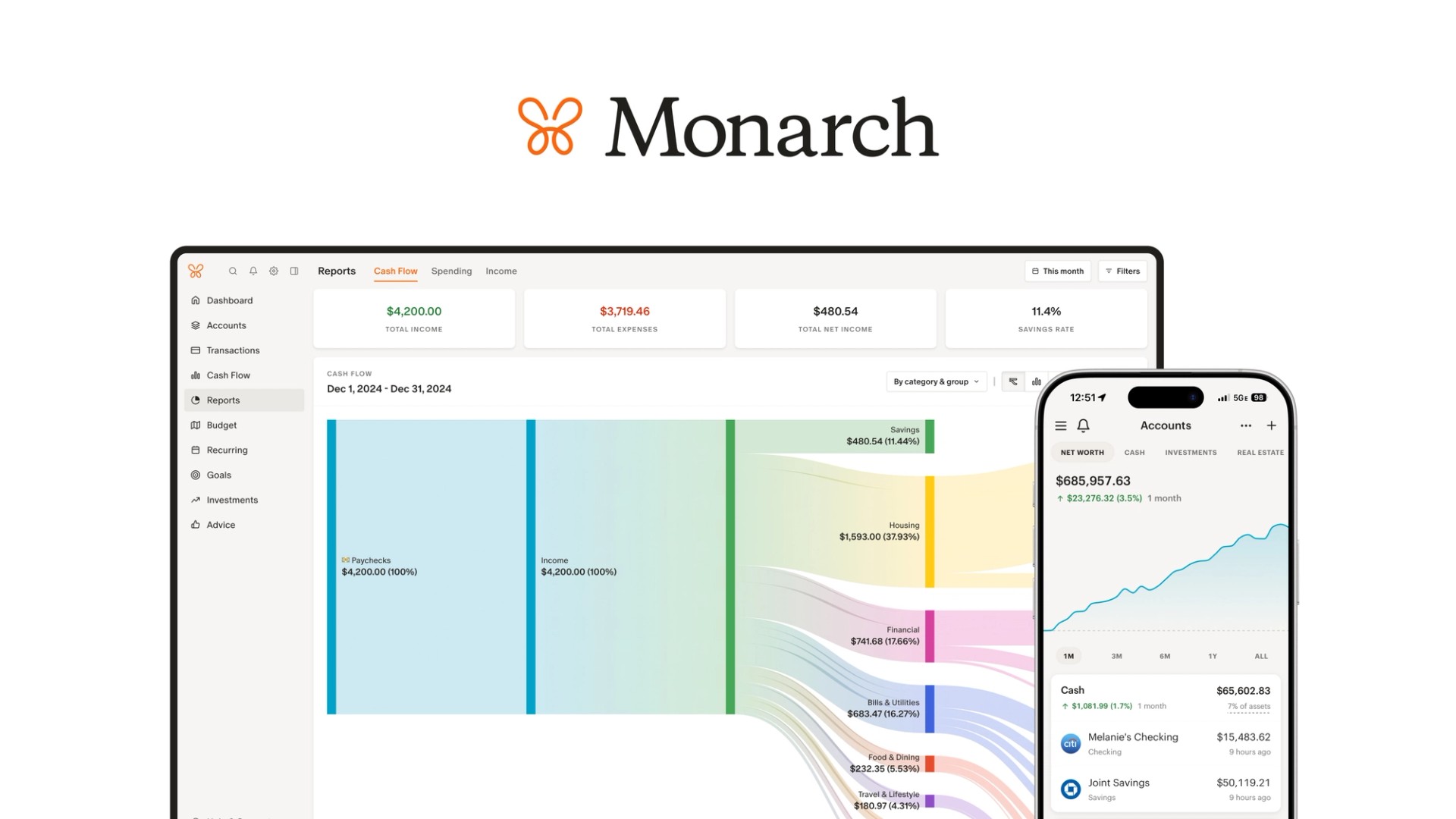

Monarch's Refreshed Look & Product Updates

Today we rolled out Monarch’s new look along with product updates to make managing your money even easier.

November 1, 2024

Introducing Bill Sync

Track statement balances, minimum due and payments made on your credit cards and loans, all within Monarch.

October 24, 2024

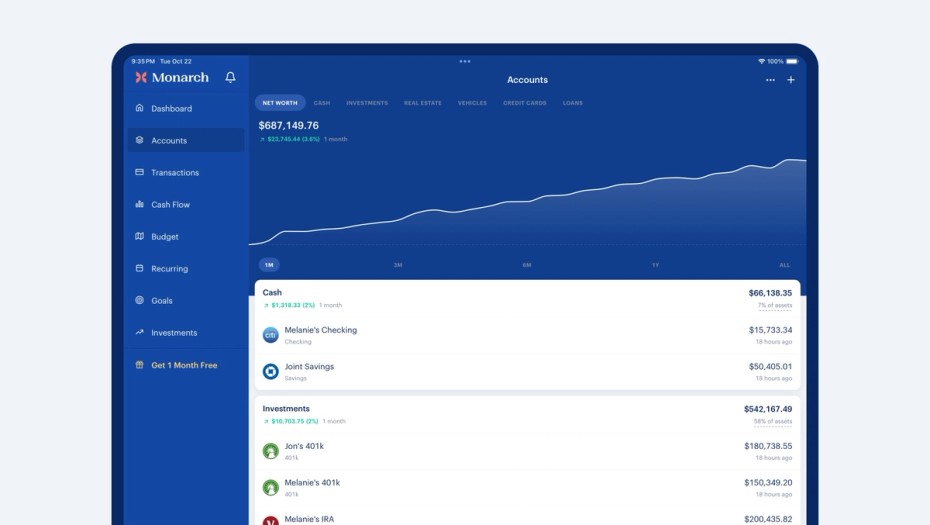

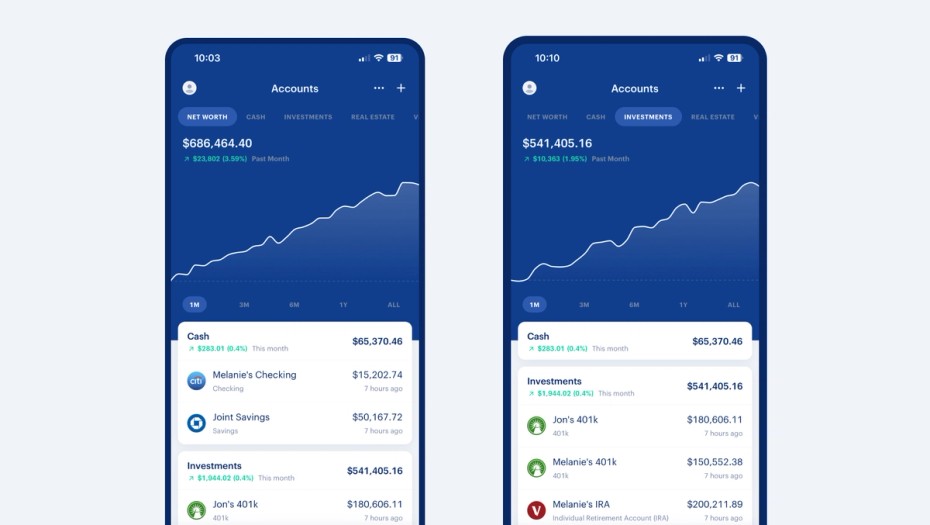

iPad support, Budget enhancements and more

Full iPad support is here! Plus, you can now customize your mobile app navigation, track your budget more visually, and more.

August 13, 2024

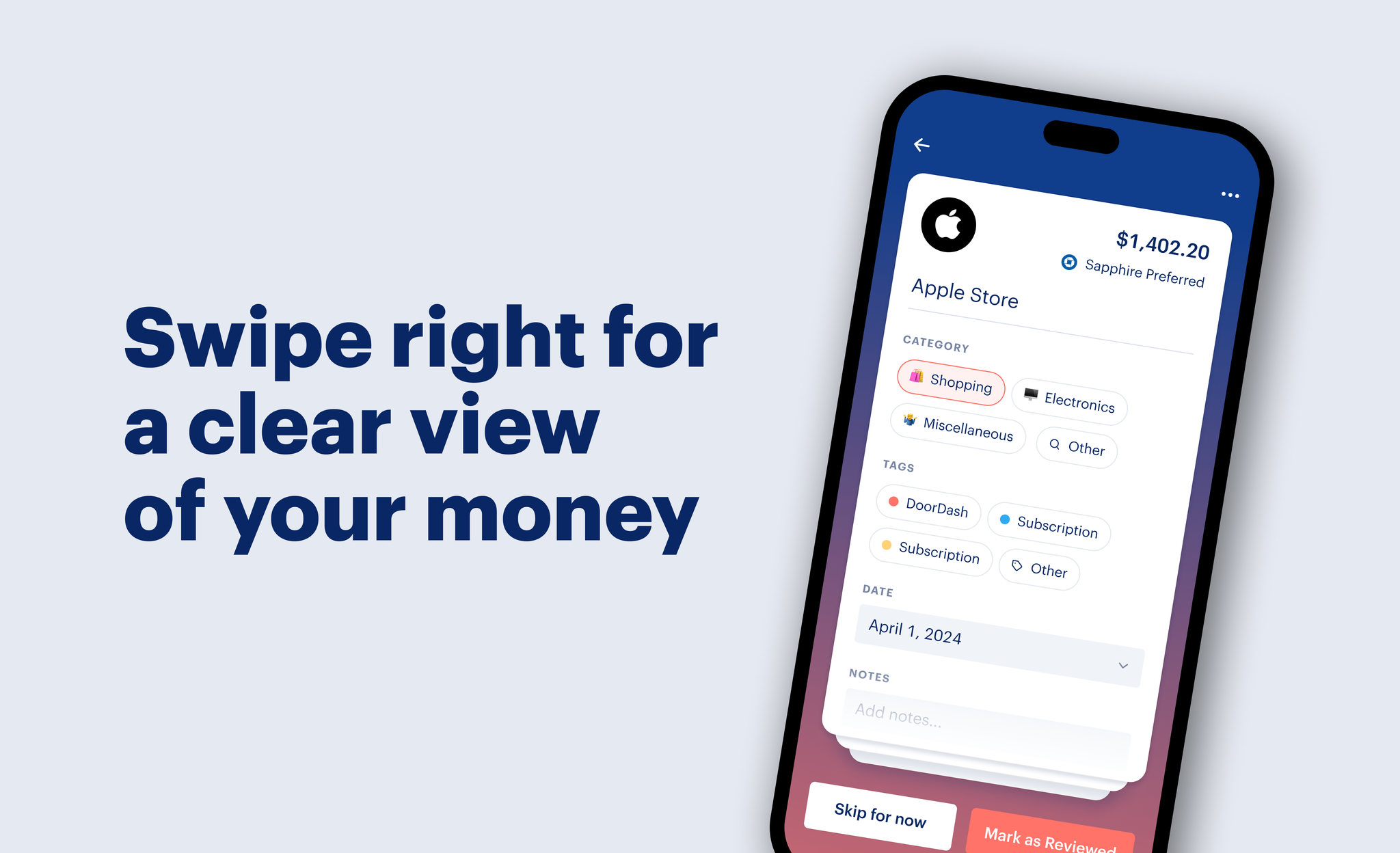

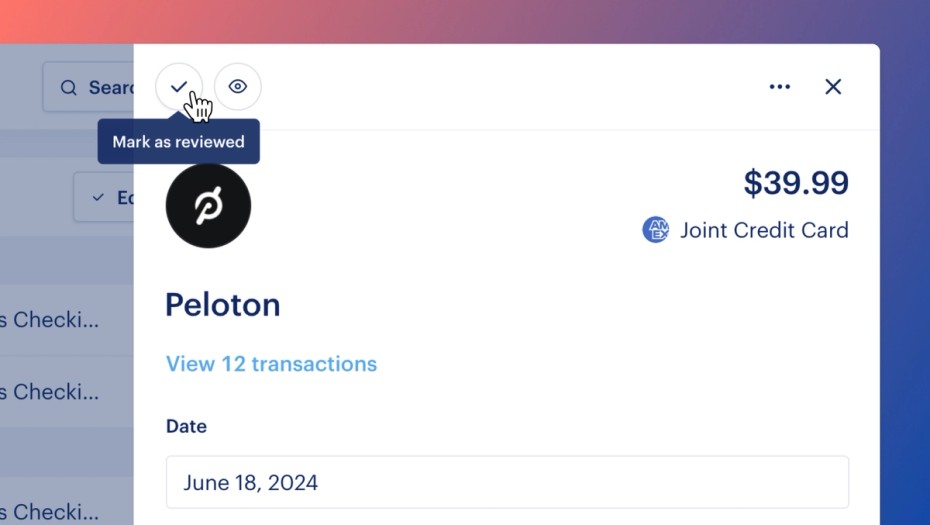

Review faster than ever, and split transactions automatically

We’ve dropped new enhancements that help make reviewing transactions 2x faster (and more fun). Plus, automatic transaction splitting is here!

June 20, 2024

Quicker and easier transaction review, and more

New improvements make reviewing transactions quicker and allow you to see more detail at a glance. Plus, we share news on upcoming bill due date integration.

April 24, 2024

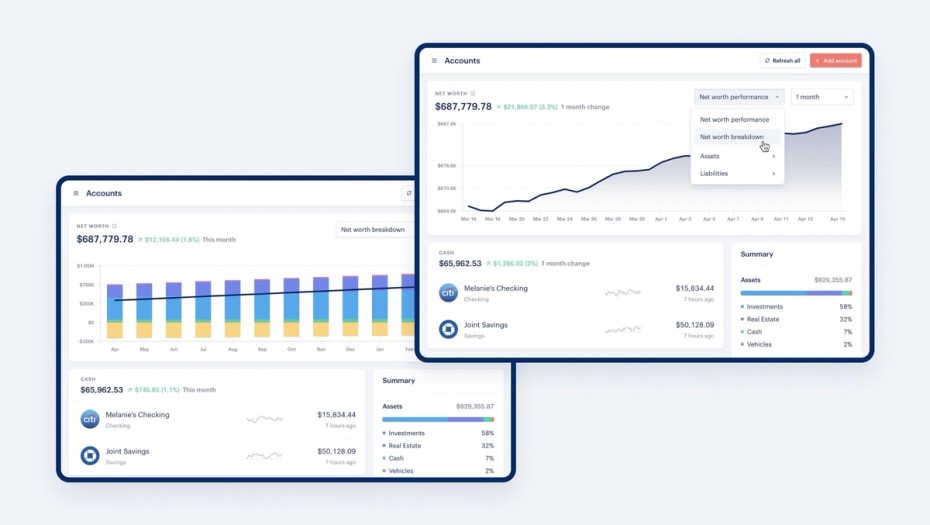

Net Worth Improvements and More!

We've launched in-depth Net Worth reporting options on web, and a number of bug fixes and performance improvements.

March 5, 2024

Sync your Apple Card, Apple Cash, and Savings from Apple Card Accounts

We've launched full Apple Card support, an improved net worth chart on web, and a number of bug fixes and performance improvements.

February 12, 2024

New Net Worth Chart, Investment Transactions and more!

This new Net Worth chart allows you to view your Net Worth over different periods of time, and interact with the chart directly to see the daily change.

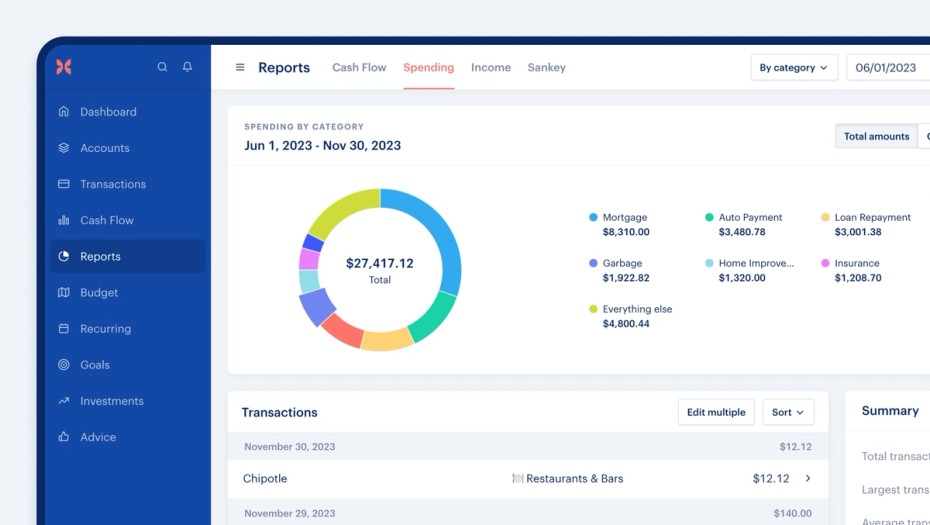

December 10, 2023

Reports, Canada, Improved Syncing

We’ve launched the initial beta version of the new Reports feature. You can now generate custom charts based on your categories, groups, accounts, tags, and more. This is a fantastic way to visualize trends in your finances.