Debt Paydown

Calculator

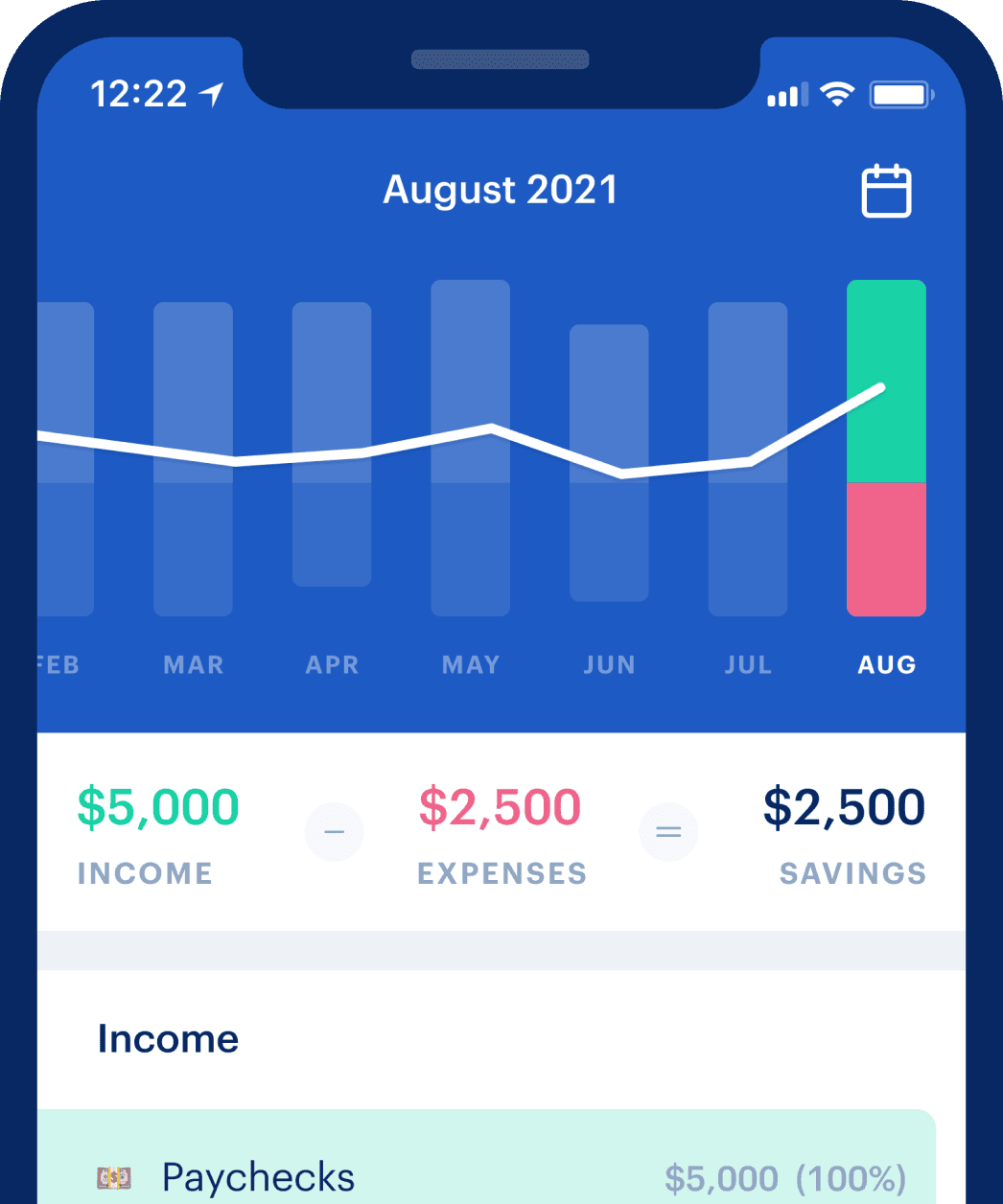

Gain total control of your money

Track all of your accounts in one place, collaborate with your partner, and create a long term plan to achieve your goals. Get personalized advice along the way.

Why is paying down debt important?

Paying off your debt is one of the best steps you can take toward financial resilience. That said, there are times when debt is good, and more often times when debt is not so good. An example of good debt would be a mortgage, assuming you can afford the monthly minimum and you have a good enough credit score to lock in a low interest rate. Learn more about calculating an affordable mortgage payment with our mortgage calculator.

What should I pay off first?

There are two common methods for deciding which debt to pay off first. They are commonly referred to as the Avalanche Method, and the Snowball Method.

Avalanche Method

The Avalanche method starts with making the minimum payments on all debt, then using any remaining money to pay off the debt with the highest interest rate. Using the avalanche method to pay off debt will save you the most money in interest payments, because it targets the highest interest first.

Snowball Method

If the Avalanche method is the best strategy to save money and time, then why have another debt repayment choice? The advantage of the Snowball method is that it helps build motivation for debt repayment. The debt snowball method involves paying off the smallest debts first to get them out of the way before moving on to bigger ones. This creates quick wins as you knock out your smaller debts first, and helps build momentum as you work toward paying everything off.

Which method should I pick?

The best method is the one you can stick to, so pick the best method for your own situation and personality. If you are someone that needs more motivation to pay off debt, take advantage of the quick wins with the Snowball Method. If you are fully committed and want to save as much money as possible, stick with the Avalanche Method.

Use the calculator above to try out both methods and see how the calculations differ. You can switch between the two methods to see how much interest you'll pay with each method, and when you'll be debt free!

As you can see, paying down debt can be complicated, so getting a clear picture of your finances and cash flow is a crucial first step to setting yourself up for success. Monarch is helping thousands of households navigate their financial life and achieve peace of mind.