Mortgage

Calculator

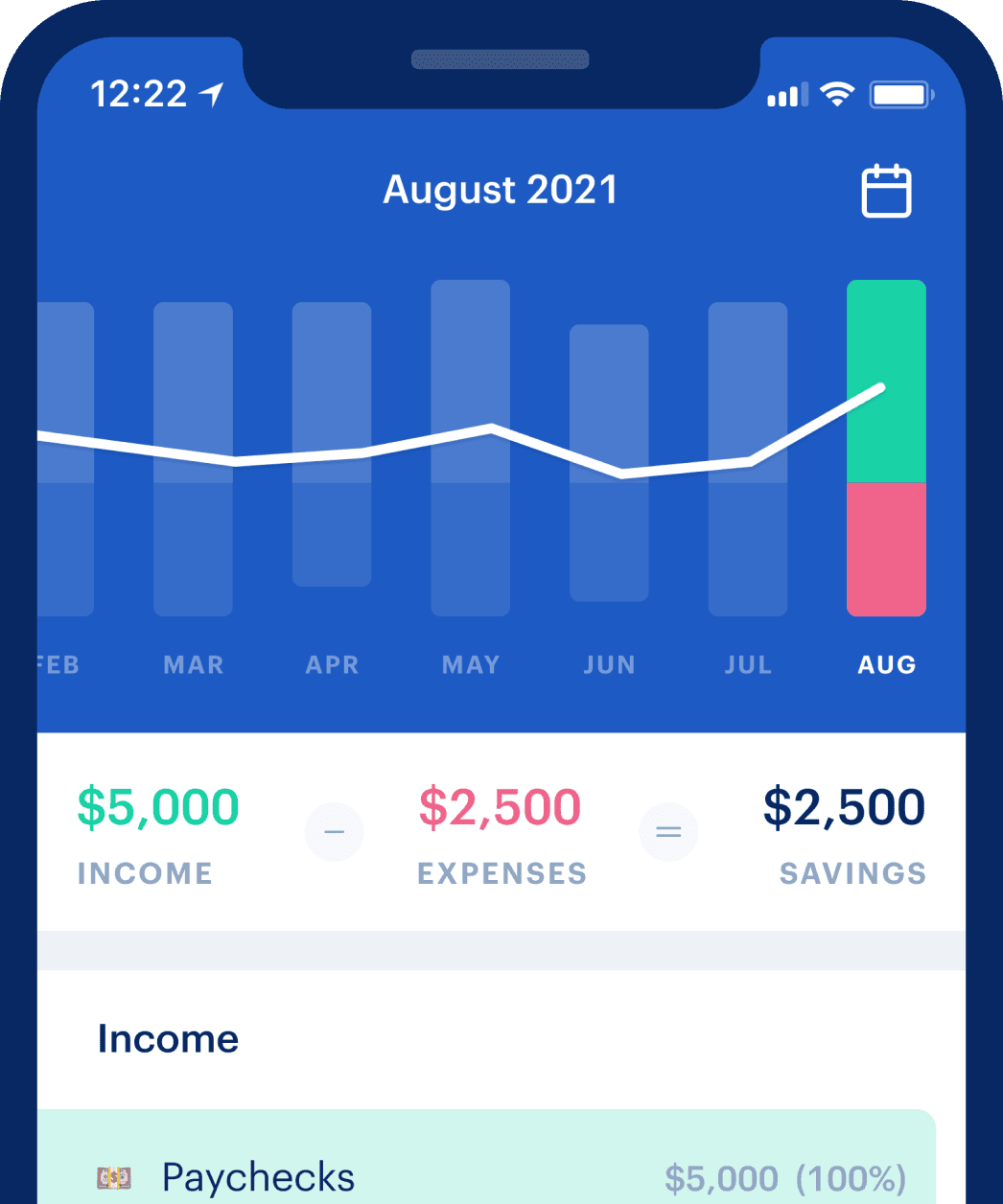

Gain total control of your money

Track all of your accounts in one place, collaborate with your partner, and create a long term plan to achieve your goals. Get personalized advice along the way.

How to calculate a mortgage payment

The mortgage calculator above uses a standard mathematical formula to calculate your monthly mortgage payments. For those interested in the math, here's the exact formula and a description of the variables involved:

M = P[r(1 + r)^n / ((1 + r)^n) - 1)]

- P = The principal loan amount. This is how much money you will actually borrow from your lender to buy the house. Think of this as the home price minus your down payment.

- r = Your monthly interest rate. Lenders typically provide an annual rate, so you should divide that number by 12 (months in a year) to get the monthly rate. For example, if your interest rate is 3%, your monthly rate would be 0.0025 (0.03 / 12 = 0.0025).

- n = Total number of payments in the loan’s lifetime. Most loans are counted in years, so multiply the number of years in your loan term by 12 (months in a year) to get the number of total payments for your loan. For example, a 30-year mortgage would have 360 payments (30 x 12 = 360).

- M = The total monthly mortgage payment. This is the number we're looking for, and the most common number to think about when figuring out how much house you can afford.

That's how the math works to calculate your monthly principal and interest payment. You should also plan for additional costs, like property taxes, homeowners insurance, and a few others. You can learn more about these costs below.

Deciding how much house you can afford

If you’re not sure how much of a monthly payment you can afford, we recommend this simple rule: Don't spend more than 30% of your income on debt. This is commonly referred to as your debt-to-income ratio, or DTI, by financial advisors. Your DTI takes into account all of your debt, not just your mortgage, so keep that in mind when thinking about it. It should cover credit card payments, student loans, car payments, medical bills, and any other debts in addition to your mortgage.

Here's an example of how to calculate your healthy debt-to-income ratio:

- Alice makes $60,000 a year, or $5,000 a month

- A healthy DTI of 30% would mean Alice spends at most $1,500 of their monthly income ($5,000 x 0.30 = $1,500)

- If Alice has $500 in existing monthly debt payments, they should plan to only spend $1,000 on their monthly mortgage payment

It's possible to qualify for a mortgage that would put you at a DTI ratio of up to 50%, but it's really important to evaluate your spending habits to ensure you have the cash flow for all of your other living expenses, and that you're able to save for your other financial goals. Lenders don’t factor in these other expenses when they pre-approve you for a loan, you need to calculate it for yourself.

Knowing how much you can afford is critical to setting yourself up for successful home ownership. The last thing you want is to jump into a 30-year mortgage that you cannot afford. Lenders are often willing to lend you more than you should take, it's incredibly important to dig into your budget and really understand what you can afford.

Other homeowner costs to consider

Most of the cost of buying a home goes to paying down the principal and interest of the loan. However, there are other expenses to keep in mind when calculating how much you can afford.

Property taxes

When you own a home, you’re subject to taxes decided by the county and district the home resides in. Property taxes can vary significantly between states, and even counties within a state. Property taxes are typically calculated as a percentage of your home’s value, so the more expensive the house you buy, the more you'll pay each year in property taxes.

Homeowners Insurance

When you get a mortgage to buy a home, your lender will require you to get homeowners insurance. This is meant to protect your home (and the lender's collateral) in case of fire, burglary, or other damage. Flood or earthquake insurance is generally a separate policy you can add on. Homeowners insurance can cost anywhere from a couple hundred dollars to thousands of dollars, depending on the location and size of the home.

Private Mortgage Insurance (PMI)

Private mortgage insurance (PMI) is an additional insurance policy required by lenders to secure a "high risk" loan. Your loan will typically be considered high risk if you don't have a 20% down payment, so if you hit this threshold you can avoid this additional cost altogether. The cost for PMI is calculated as a percentage of the original loan amount, and can range from 0.25% to 2% depending on your credit score and the size of your down payment. If you do end up having to pay PMI, you can request to stop paying it once you hit the 20% equity threshold.

HOA Fees

Homeowners association (HOA) fees are most common when you buy a condominium, but can also apply to homes in communities with shared spaces (pools, parks, etc.). The fees cover upkeep of the public spaces. When you’re looking to buy, the HOA fees will be disclosed upfront, so you should use them to calculate if you can afford the property or not.

General home costs

For first-time homebuyers, it can be a shock how much work is involved with maintaining a home. If the homes you are looking to buy have a large lawn or garden for example, be sure to consider the additional monthly costs of hiring a gardener, or the equipment costs and personal time you'll need to do it yourself.

There will also be new utility costs you may not have had to pay before, like garbage. Overall, it's a good idea to always give yourself some cushion in your budget to make improvements to your home while also saving for your other financial goals.

How to lower your monthly mortgage payments

If you're trying to lower your monthly mortgage payment to something more affordable, there are a few levers you can pull to achieve that:

- Buy a cheaper house. This one is simple, the less expensive the house, the lower the monthly mortgage payment. This is also likely to lower your property tax costs.

- Choose a longer loan term. If you increase the number of years you’re paying off the mortgage, the monthly payment will be smaller. You will end up paying more in interest long-term, but for many families that is worth it for the lower monthly payment.

- Pay a larger down payment. The more you pay up front with your down payment, the smaller the loan principal will be. If your down payment is 20% or more of the home cost, you'll also be able to avoid the additional PMI costs mentioned above.

- Secure a lower interest rate. Your interest rate impacts your monthly payment, and how much you'll pay in interest over the lifetime of the loan. You should shop around with different lenders to secure the best interest rate you can find.

As you can see, costs can add up quickly when buying a home, so getting a clear picture of your finances and cash flow is a crucial first step to setting yourself up for success. Monarch is helping thousands of households navigate their financial life and achieve peace of mind.