Over the past month, we've made substantial improvements to account connectivity, making it easier than ever to connect and maintain your accounts in Monarch.

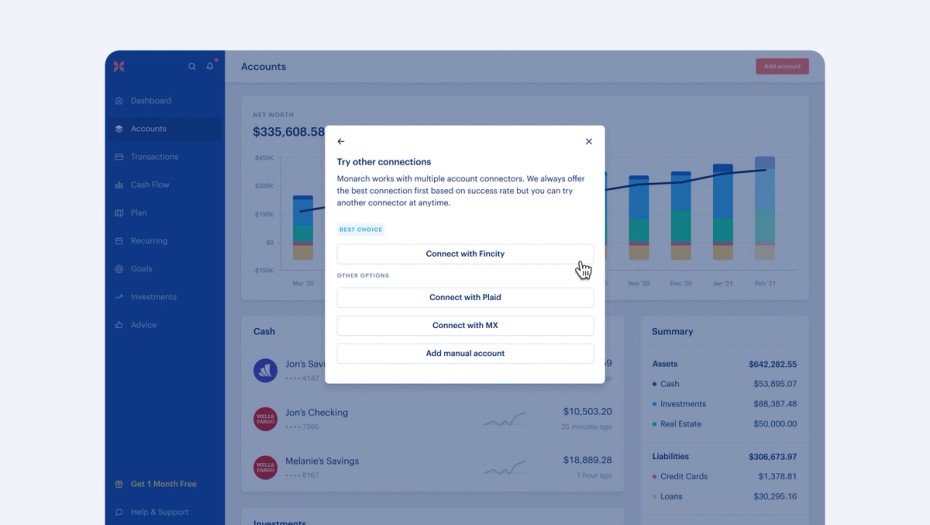

- Choose your preferred aggregator: Monarch works with multiple aggregators to offer the best connectivity possible. While we monitor connection health to choose the best aggregator for a bank by default, you can now select your preferred aggregator from the account connection screen (search for your institution, then click the three-dot menu).

- Institution Settings page: We have introduced an Institution Settings page, available on both web and mobile, where you can view your overall connection status, see what institutions and accounts you have connected, and take debugging steps if needed.

- Improved "last updated" timestamps: We have fixed several cases where the "last updated" timestamp was inaccurate based on the data received from aggregators. This improvement ensures that you have the most accurate information about your account updates.

- "Update login" feature: From your Institution Settings page, you can now "update login" to re-establish the connection to your financial institution. This is especially helpful if old accounts are "stuck" or new ones aren't showing up. This feature is available on both web and mobile.

- Refresh all accounts improvements: We have enhanced our ability to refresh accounts and pull their latest data. This functionality is now available in different parts of the product, such as the Institution Settings page, Accounts page on the web, and swipe-down-refresh on the Accounts page on mobile.

Other Improvements

- Editing pending transactions: We have reintroduced the ability to edit pending transactions. You can now find an "Allow edits to pending transactions" toggle in your settings, allowing you to choose between editing pending transactions or excluding them from cash flow and budget calculations.

- Monthly Email Report: We launched a new Monthly Report email to keep you informed about your finances. This will go out in the first week of each month, and summarize what happened with your money in the previous month.

- Download CSV data: One-click CSV download of all account balance history from the Accounts page.

- Cash flow reporting by Group: To see more details about your cash flow in categories within a certain group, simply click on that group on the cash flow page.

- Delete transaction rules: If you’ve had a lot of transaction rules build up over time, and want to start from scratch, you can now delete all of your transaction rules (web only).

Bug Fixes

- Fixed an issue with the account list not populating when creating a transaction rule.

- Resolved an error when sorting by security on the Investments page.

- Fixed an issue, on some devices, where customers were seeing a “resolution not supported” error when connecting financial accounts.

- Fixed an issue on the current month of the Plan page where a rollover budget amount was not available to move to another category until a budget amount was set.

What’s Next

We’re exploring a bunch of ways to improve budgeting in Monarch to better support all of the unique ways people think about their money. Here are some things we are focusing on:

- Improved rollovers: Rollovers will project into the future to help you better plan for future months. There are a few bugs we want to squash related to rollovers as well.

- Group-level budgeting: Instead of budgeting every category, you’ll be able to set a budget at the group level, and all spending within that group’s categories will count toward the group’s budget. This is great for groups like “Food”, where you don’t necessarily care if that budget goes to “Restaurants” or “Groceries”, as long as you stay within your overall “Food” budget.

- Linking transactions to goals: We’ve heard a lot of feedback about contributing to goals, and how you want to link transactions to them. We’re exploring a few ideas for how to address this to make it more flexible and easier to understand.

We’ve been playing with AI… more to come soon 🙃