It's been an exciting few weeks at Monarch. We've been thrilled (and yes – occasionally overwhelmed) by the influx of ex-Mint users. We are committed to listening to you (our customers) and building the best-in-class personal finance solution for your needs. Thank you for everyone's patience while we address some of the growing pains.

We regularly provide these updates to keep you informed about the recent enhancements in Monarch, as well as what's to come. Let's get into it!

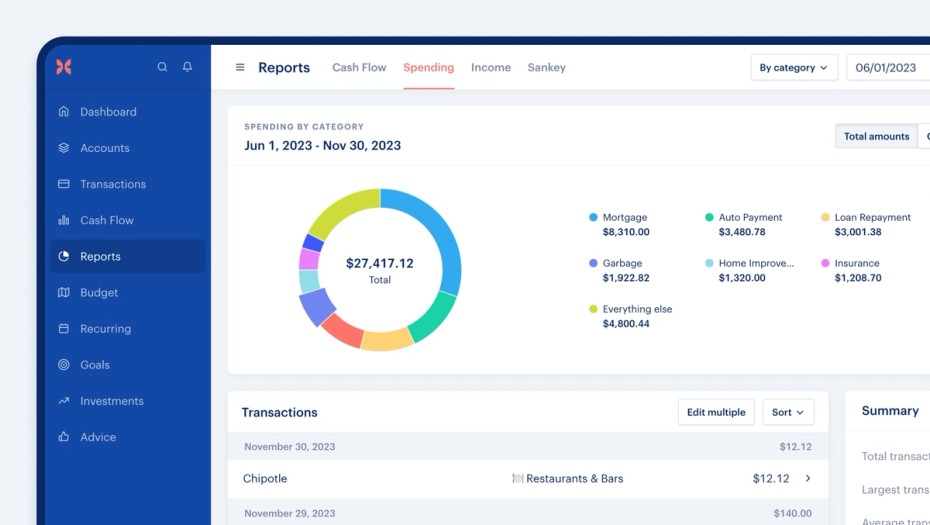

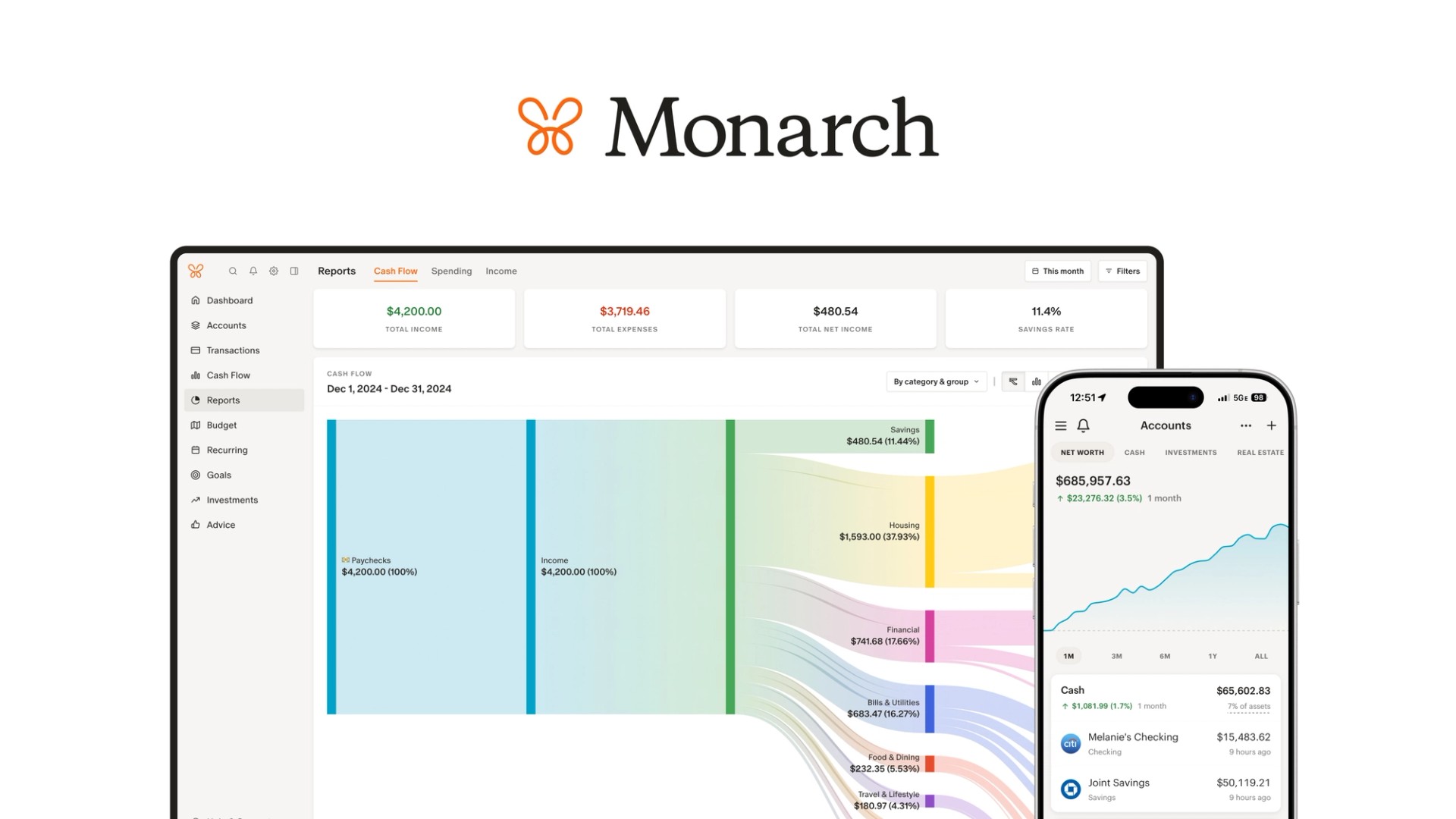

New Reports Functionality

We’ve launched the initial beta version of the new Reports feature. You can now generate custom charts based on your categories, groups, accounts, tags, and more. This is a fantastic way to visualize trends in your finances.

We’ve improved the date range picker user experience as part of this too, and built a new filter dropdown that packs a ton of options into one simple menu. Check it out with your own data here. The Reports feature is only available on the web app today, but we'll be adding it to the mobile app in the future.

Learn more about Reports in our Help Center.

Now available in Canada 🇨🇦

We went international! We launched in the Canadian App Store and Google Play Store and have been analyzing the quality of bank connections for our friends in the north. We’ll be keeping an eye on this and comparing the quality to our US bank connections.

Android Performance

We’ve addressed some bugs that were causing crashes for some users of the Android app. We're also working on a number of other performance improvements that should make the app feel much faster for Android users.

Customer Support Hiring

One thing that did not scale well with the inflow of Mint users was our customer support. We received more requests in November when the Mint news broke than we did in all of 2022. To address this, we’ve tripled our customer support team size, and have been training the new reps to get them up to speed.

If you have a ticket that has gone unanswered for a long time, we are deeply sorry and want you to know that we do not see that as an acceptable experience 😞. Before the Mint news, we typically responded to every ticket within 24 hours. We’re working very hard to get back to that benchmark, and we are grateful for your patience.

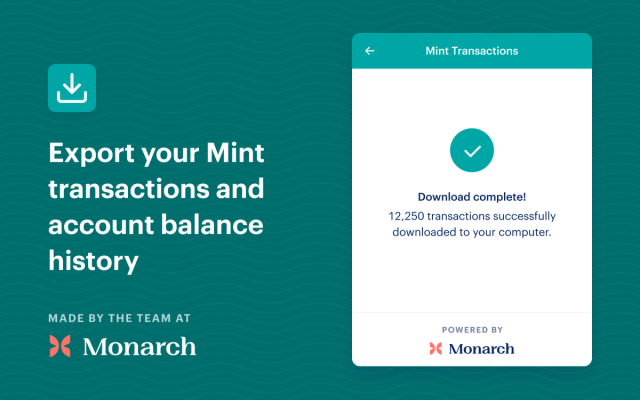

Mint Data Exporter Chrome Extension

We built and open-sourced a chrome extension in just a couple of days after the Mint news dropped to help the Mint folks export all of their data easily. It’s now been used by over 7,000 people according to the Chrome extension store. If you still need to export your Mint data, you can get the chrome extension here. Thank you to everyone who contributed to the open source codebase too!

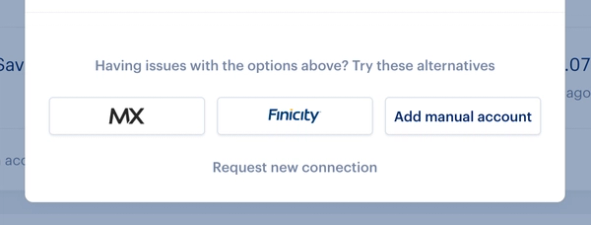

Easier to Select Data Connection

We've changed our UI to make it much easier to select alternative data partners when syncing accounts. This is a great option if you're unable to sync an institution with the primary data partners. Note that this is currently on the web app only, but will be added to mobile soon.

Balance History Import Improvements

We squashed some bugs and made it easier than ever to backfill your account balance history. We now allow gaps in the dates within your file upload, and we automatically fill in these gaps with the balance from the previous day. You can also now import your balance history into manual accounts, not just synced accounts. We also added balance history import to the Mint import flow to simplify the process when importing multiple accounts.

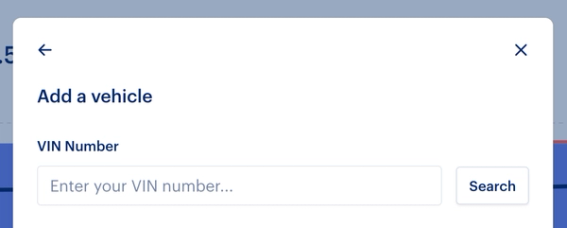

Car Value Syncing

We’ve connected our first aggregator that lets you automatically track your car’s value. This value won’t change frequently, since your car value doesn’t tend to depreciate within a month. Expect monthly syncs for these, similar to real estate values. We’ll also be testing additional aggregators to compare price accuracy based on more data points like mileage, etc.

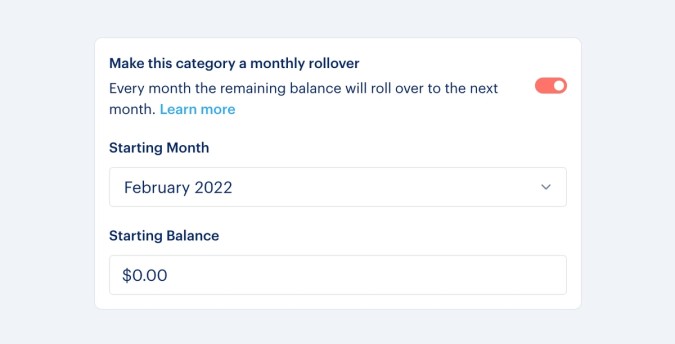

Budget Improvements

You can now set a “starting balance” for your rollover budgets. This gives you more control over the rollover amounts and how they carry forward. We also renamed the “Plan” to “Budget” in the main navigation.

Other Improvements

We’ve made a ton of other improvements across our web and mobile apps:

- Integrated an American Express OAuth connection, balances and transactions (including pending) are now syncing.

- The Mint import flow now has the option to explicitly prioritize Mint import transactions over newly synced data from financial institutions, and the ability to map all categories and tags. We also updated the default option on the account mapping step to “Ignore account” instead of connecting a new financial institution within the flow. This way you can more easily ignore a financial account in the moment, and always come back later and import more data.

- Made it easier to request support for a new financial institution. You can find it on the “Add account” screen. Please use this option if you search for an institution and cannot find it in the list. There is a short form with key information that will help us efficiently work with our data providers to request support.

- Extended the historical net worth view when looking at Quarterly and Yearly time periods on web. You can use the arrows on the sides of the chart to go see how your net worth has changed over time.

- Made it easier to type dates into the transactions date range picker on web.

Bug Fixes

- We addressed a number of bugs with the Mint Import flow. Thank you to all the customers who sent us their files to help debug their issues 🙌

- Fixed an issue where some users got into a state where they had transactions linked to a deleted category, which would crash the mobile app

- Fixed an issue where typing a space wouldn’t insert it into the merchant search picker on web

- Fixed an issue where some users had duplicate categories created during the Mint Import

- Fixed an issue where categories appeared out of order between web and mobile

- Fixed an issue where the daily net worth report would send multiple times to some users

What’s Next

- Investment transactions

- We’ve been internally testing syncing investment transactions. This will open up a lot of great use cases, like being able to assign investment transactions to goals, as well as being able to budget for dividends. It will also let you report on fees, so you know exactly how much is going to your investment brokers.

- Goal improvements

- We're working on a more advanced (and intuitive) approach to Goals that will launch in early 2024.

- Bill tracking

- We'll be adding the ability to view your bill amounts and due dates

- Net worth charts on mobile

- We had a design discussion in our Reddit community on how to improve our net worth history charts on mobile, and are excited to bring these changes to our apps based on all of your feedback.

- We're Hiring!

- We'll be hiring for a number of new roles across engineering, product, design, and marketing so that we can move even faster and better serve you. These roles will be posted in the coming weeks. We love hiring Monarch customers, so if this sounds interesting keep an eye on our careers page for the new roles.